Why cash is king

The first set of results from our inaugural compensation survey reveals the need for stable income above all else

👋 Hey, I’m Lenny, and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Lenny and Friends Summit, happening October 24th | My recruiting service to hire your next product leader | My favorite Maven courses | Lennybot | Podcast | Swag

Last month, I announced our inaugural Lenny’s Newsletter Compensation Survey, and the response was far beyond what I’d hoped for. Readers immediately jumped in to share raw numbers and what matters most to them when it comes to comp—and many told us things I didn’t anticipate.

My aim with this survey series is to create a trusted compensation benchmark for tech roles, while also tracking changes in employee sentiment and priorities around comp. This first analysis focuses on the latter: a deep dive into what tech workers value most in compensation.

With over 5,000 detailed responses, I haven’t seen another compensation survey reach this scale. To help me design and run this survey, I tapped my former colleague Louise Beryl, who recently helped lead the research team at Figma and, prior to that, was managing teams and doing research at Airbnb, Instagram, and Chegg. She’s my go-to advisor on all things surveys, and I’m thrilled to be collaborating on this work with her. Enjoy!

When it comes to evaluating a compensation package, especially in the tech industry, everyone has their priorities. But what really matters to people today when they receive offers and try to negotiate? We analyzed just over 5,000 survey responses from this community (all subscribers of Lenny’s Newsletter, globally!) who are currently employed in full-time jobs (or have been in the past six months) and found clear—and surprising—trends that reveal what truly matters in compensation in 2024.1

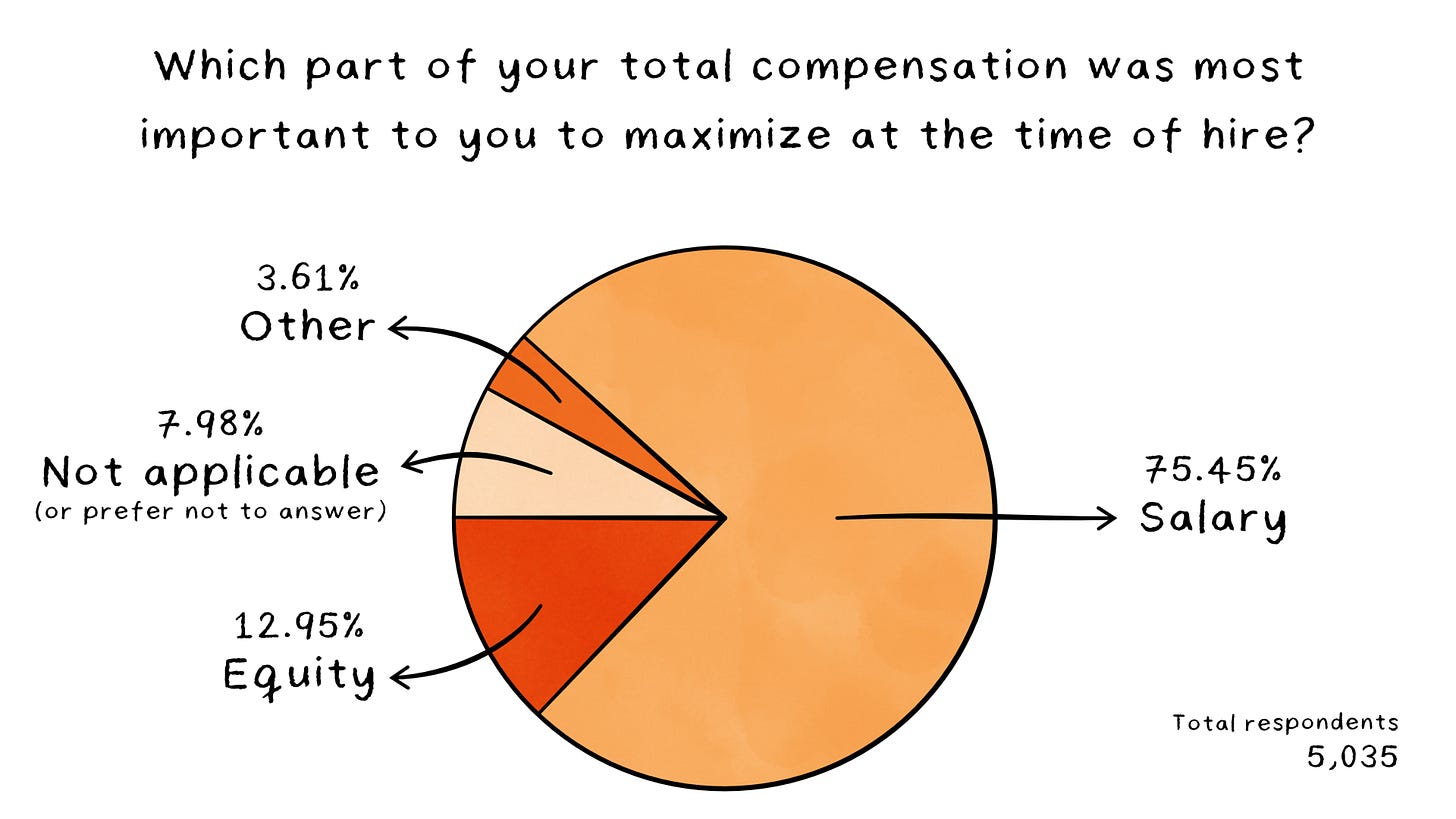

What matters most: salary, salary, salary

When evaluating a job offer, the most common priority for tech and other professionals is clear: salary. A significant 75% of respondents selected salary over equity as their top priority during negotiations (n=5,035) [see pie chart below that shows the breakdown of equity vs. salary]. This was surprising, given that in the tech sector, FAANG (aka the Magnificent Seven) stock has historically been lucrative and startup equity has been seen as the path to life-changing wealth. Just 13% of respondents selected equity over salary, while 4% highlighted several other considerations beyond salary or equity (and 8% indicated that the question wasn’t applicable or preferred not to answer). We are also surprised by the strength and clarity of their preference and reasoning, given the diversity among respondent demographic profiles (in gender, geographic location, years of experience, and education level) and professional profiles (industry, company stage, functions).2

So why did salary dominate this survey? Our takeaway from qualitative answers is that after Covid, years of inflation, and a potential recession, people are ultimately looking for stability. They need to meet the demands of life, and many have experienced setbacks that make them approach compensation offers more practically than we anticipated.

1. Salary = stability

“Cash is king.” This phrase was echoed repeatedly by respondents in explaining why salary was their main priority. The predictability and security of a stable paycheck are vital. “Salary is guaranteed. Equity is not. I need cash to pay the bills,” noted one IC engineer at a late-stage fintech startup. Even an executive in product at a series B company put it, “My base salary is what I use to live life, and bonus/equity/etc. are not guaranteed.”

High cost of living and family responsibilities demand cash flow. For professionals living in high-cost-of-living (HCOL) areas, the importance of salary becomes even more pronounced. As an engineer at a series A startup succinctly put it, “Living in NYC is expensive af!” The need to cover daily expenses often outweighs the potential future gains of equity: “Equity doesn’t pay rent,” a PM at a series B startup explained. The immediate cash flow provided by a solid salary is crucial for these professionals as they navigate the high costs associated with tech hubs like San Francisco and New York.

Life stage also plays a significant role in shaping compensation priorities. For those with families or major financial responsibilities, the need for a guaranteed income often takes precedence over potential future rewards. “I have a family to support, and cash in hand is, well, necessary,” a VP of growth shared, emphasizing the importance of a steady paycheck in managing household costs. A marketing C-suite executive at a bootstrapped company with 100-499 employees said, “I’ve got little kids and need to live in an HCOL for work. I understand the upside of working for equity in a growth-stage company (and have benefited from it), but it doesn’t pay the bills,” highlighting the financial pressures that come with balancing a tech career and family life in expensive cities.

2. Equity skepticism is real

Equity, once considered the golden ticket to long-term wealth in tech, is now viewed more cautiously. Many respondents noted that they have had experiences where equity did not yield the expected returns, leading them to prioritize salary as the safer, more reliable option. A veteran senior director of product with 10-15 years of industry experience reflected: “Never had equity turn into anything in the past but hopes and dreams.” The experience of financial downturns, layoffs, or startups with no liquidity events has led many to prioritize cash, which offers immediate value over future uncertainty.

The sentiment that “equity is a lottery ticket” captures the general mistrust and preference for the immediate, tangible benefits of a strong base salary. “Equity is Monopoly money,” quipped a female VP/head of product at a series C startup in the U.S.

“Equity is Mickey Mouse money and can be an amazing upside in the long term, but we can’t count on it,” echoed a male VP/head of product at a series C startup working from Brazil. And there are some who have stronger opinions: “(Hot take) I believe equity is a scam to get early-career employees to work more for less. Even in the best-case scenario, an IC at a seed startup, [you] might exit with enough to buy a car but not enough to buy a house. The days of becoming a millionaire through equity are few and far between. With a higher salary invested over time, you’ll end up with the same amount,” said a female senior IC working from Canada for a series A startup.

With past experiences of equity failing to deliver returns, some have become skeptical of its potential. Salary offers the reliability needed, particularly in an uncertain economic environment, where equity may be less likely to materialize into tangible benefits.

Is this equity skepticism a new trend? Since this is the first time we ran this survey, we can’t definitively say. However, anecdotally, from our experience in the tech world in the past 10 to 15 years, this narrative feels markedly different from the wisdom we used to hear: “Be a missionary, not a mercenary. Maximize your chance for life-changing wealth and ask for more equity.” Perhaps those with more years of experience in the boom and bust of tech cycles can attest to whether the predominant sentiment is brand-new or just re-emerging. Nevertheless, one thing is for sure: in October 2024, people are craving the stability and predictability of liquid cash compensation. We will continue to follow this prevailing sentiment as we benchmark this data going forward.

Who cares about equity?

Based on logistic regression analyses, several factors emerge as predictors of equity preference. Gender has the strongest statistically significant impact on the likelihood of selecting equity over salary, with men 2.3 times as likely to prefer equity compared with women. Job level also strongly influences equity preference, with senior executives and founders showing a higher preference for equity compared with people managers and ICs. In fact, for each increase in seniority level (from IC to people manager to executive), the likelihood of prioritizing equity over salary increases by a factor of 2.0. When considering years of experience, employees with more experience are more likely to prioritize equity over salary compared with those with less experience. Respondents in the higher-experience groups (4-9 years and 10 or more years) are 1.53 times as likely to prefer equity compared with those in the lower-experience group (<4 years).

Geographic location also has an impact: employees in the U.S. are 1.75 times as likely to prioritize equity as those outside of it. Respondents from Canada, Germany, the U.K., and other non-U.S. countries are statistically significant predictors of a lower preference for equity, with the U.K. having the strongest negative effect (0.44 odds ratio). Also notable, respondents in the European Union are 42% less likely to prioritize equity compared with those in other regions.

Company stage (publicly traded vs. privately owned) also plays a significant role, with employees at early-stage companies (from pre-seed through series D or later) 1.34 times as likely to prioritize equity, while those at publicly traded or later-stage companies tend to prefer salary. And finally, company size is a statistically significant, albeit smaller, predictor of equity preference—as company size increases, the preference for equity slightly decreases (odds ratio of 0.94).

Overall, the interplay between a person’s demographics, experience, location, and company profile significantly drive equity preference.