👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out about work. Send me your questions and in return I’ll humbly offer actionable real-talk advice. Now, on to this week’s post…

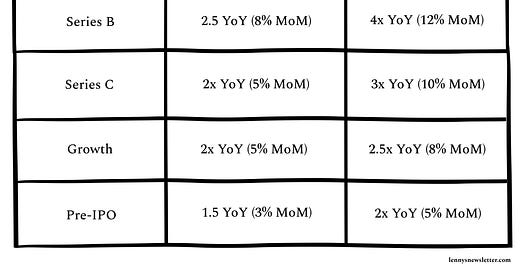

Q: What growth rates do investors expect at each stage of the business?

To get you a clear answer, I reached out to two dozen of the smartest investors I know and asked them what they consider GOOD and GREAT growth rate by stage of business. Below is what I learned.

Huge thank-you to the following amazing people for sharing their insights: Alexander Taussig and Arsham Memarzadeh (Lightspeed), Andrew Chen and Olivia Moore (a16z), Arra Malekzadeh (Craft), Caitlin Bolnick Rellas (CRV), Daniel Levine (Accel), Elad Gil, Ellen Chisa (Boldstart), Grace Ge (Menlo), Grant Ebenger (Tiger), John Luttig (Founders Fund), Jonathan Golden (NEA), Kanyi Maqubela (Kindred), Kimberly Tan (a16z), Leo Polovets (Susa), Mike Duboe (Greylock), Mike Vernal (Sequoia), Niko Bonatsos (GC), Nina Achadjian (Index), Patrick Chase (Redpoint), Rebecca Kaden (USV), Sandhya Hegde (Unusual Ventures), and Todd Jackson (First Round) 🙏

Takeaways

1. In the early stages, investors don’t care about month-over-month growth

Why? Because percentages with a small base don’t mean much. This sentiment was true across every investor I talked to, e.g.:

“I look at MoM only really as a proxy for how fast it ramps to $1m ARR.

We don’t anchor on the specific percentages for MoM growth because the percentage represents a pretty small dollar difference with small denominators. For example, 10% vs. 20% growth at $100K ARR isn’t substantial. Every percentage means different things in an absolute sense when the denominator is small.

Another way of thinking about it through a MoM lens is that we’d want to see accelerating MoM growth (it going from 10% to 12% to 15%, for instance) to see that the company is picking up momentum.”

—Kimberly Tan, a16z

That being said, if you’re looking for a month-over-month benchmark below $1m ARR, answers typically fell in the 15%-25% range.

2. Instead, for early-stage B2B businesses, investors focus on how quickly they ramp to $1m ARR after going live

As John Luttig (Founders Fund) put it:

“In the early stages it’s mostly about time from launch to your current ARR.

If you grew to $500k ARR in 3mo post-launch, that’s more impressive than $1m in 24mo post-launch. Generally, 0 to $1m ARR in 12mo or shorter is great. There are obvious exceptions to this—not every company’s success can be measured in ARR since launch (Figma, OSS, etc.).”

Broadly, the expectation is that getting to $1m ARR within a year of launch is GOOD, and getting there in three quarters (9 months) is GREAT.

As Sandhya Hegde (Unusual Ventures) said, “You start the growth clock the month you go GA.”

Grace Ge (Menlo) shared a similar point:

“Velocity is everything post-launch. As the company matures, it’s less about convincing investors to dream the dream and more about proving the dream is real, executable, and monetizable.”

For this reason, you want to be strategic about when you launch:

“The great irony is that once you start having numbers, investors start to really care what those numbers are.”

—Caitlin Bolnick Rellas, CRV

“If you’ve launched and have very little traction, it’s worse than being pre-launch, because it shows the market/value prop is already demonstrably weak. This is why no data is better than bad/small data.”

—John Luttig, Founders Fund

However, a couple of investors specifically said that they don’t care about how long it takes you to get going, as long as when you do get going, it really gets going:

“We’re less concerned about ramp to $1mm of ARR, or growth rates every year after launch. Some of our biggest winners took several years to really get going and find strong PMF. But once they do, we want them to take off. In other words, if a business grew revenues from $500k > $5mm this year, I wouldn’t care whether it was launched 1 or 5 years ago.”

And if you get out of the gate slowly, you can sometimes still catch up:

“Investors tend to prize early velocity. This makes sense: it increases the likelihood that you will compound to very high revenues. But speed of 0 to $1M of ARR has, in my experience, been less predictive than speed from $500K to $5M ARR. The latter is indicative of having ‘minimum viable durability’ of your revenue, which will compound over a longer period. Oftentimes, during the 0 to $1M phase, a company is still working to optimize retention, experimenting with efficiency, and initially segmenting their customers.”

—Kanyi Maqubela, Kindred

3. If you don’t have strong immediate ARR growth, you can show success in other ways

Without fast ARR growth, you’ll need to show strong signals that people really want your product—through high retention and efficiency:

“Revenue growth is really an output for what else is happening in the business—basically how much customers love the product and how efficient it is to get more of them. Cohorted revenue retention and/or purchase behavior (ideally U-shaped cohorts where net revenue retention goes up over a year) and marketing spend/revenue (efficiency) are the most important factors to the health and velocity of a business.”

—Rebecca Kaden, USV

“The key thing is that there’s some leading indicator of ARR that is intrinsically compounding at a high rate. It’s often early users with taste representative of future users loving something. For example, if the business is going to be sales-led, are our salespeople incredibly productive (or do I think they will be)? Are sales cycles oddly short, do customers rave about us and tell their friends (typically leading to oddly low CAC), etc.?”

And Ellen Chisa (Boldstart) reminds us that in the early days, it’s often a trap to focus too much on growth:

“It’s a huge mistake to focus on the growth number before getting retention. You can often hit the ‘great’ number at an early stage by brute force because the numbers are so small. Unfortunately, that won’t translate to continued growth, and then you’ll end up in a worse place than if you’d spent longer to hit the fundamentals.”

And the quality of your ARR often matters just as much as your growth rate:

“Beyond simply growth, it’s equally important to look at components of ARR (new, retained, expansion, resurrection, contraction, churn) and customer concentration, and be mindful of the sustainability of growth (e.g. how’s sales efficiency and CAC payback? How does new ARR compare to sales and marketing spend?).”

—Arra Malekzadeh, Craft

4. Along those same lines, for early-stage consumer businesses, it’s all about intensity of engagement, virality, and retention—not revenue

For B2C businesses, early-stage consumer investors look for how intensely people use the product, and share the product, versus revenue growth. For example, Mike Vernal (Sequoia) shared:

“For consumer, I focus on engagement and retention first and foremost. >50% DAU/MAU or >50% D30 retention is excellent. If you have both of those, only then do I worry about whether you can grow it.”