Hello and welcome to another edition of my weekly newsletter! My name is Lenny, and each week I tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out at the office. Send me your questions (just reply to this email or DM me) and in return, I’ll humbly offer some real-talk advice. 🤝

If you find this newsletter valuable, consider sharing it with a friend 🤜🤛

Q: Like many startups these days, we’re struggling with growth and retention as a result of the Coronavirus downturn. Any advice on what we should do?

I’ve been increasingly getting this question, so I’m going to take my best shot at it this week. Since I’m not inside a company dealing with this personally, I’ve instead pulled together recommendations from the best growth people I know — people who are on the ground doing the work right now.

The first thing to know is that you are not alone in this.

Let’s just acknowledge: This shit is hard. If you are sitting there thinking, oh man this feels so much easier for everyone else than it does for me — it’s just not true. If you are stressing, just know everyone else is too. Ask for help if you need it.

— Brian Balfour, CEO of Reforge

To that point, below you’ll find advice from folks at Reforge, Harvard Business Review, Sequoia, Dan Hockenmaier, Elena Vern, Patrick Campbell, Cyan Banister, and a bunch of other smart people. We’re in unprecedented times and everyone is learning as they go, so if you have any additional advice, ideas, or learnings you’ve found valuable, please share them in the comments below. 🙏

1. Determine if you should be in survival mode, tweak mode, or accelerate mode

As Leo Polovets half-joked, this virus has been the Thanos of business — companies that were thriving just a few weeks ago are on the verge of imploding, and companies that were doing nothing special are all of a sudden taking over the world, e.g…

So step one is to figure out where you stand.

When you look at your business, you’ll fall into one of three buckets:

You are seeing growth

You are falling apart

You are chugging along

Figure out which bucket you are in.

This will mostly depend on which sector your business is in. It should be pretty easy to tell.

Kevin Barry (founder of Right Percent) shares some stats about how many of his (B2B SaaS) clients fall into each bucket, and what he’s recommending for each (more on this later):

20% of clients in growth markets: Land grab for market share. Right now CAC is low, and LTV is forever. Broad audience prospecting.

20% of clients in hard hit target markets: Pause prospecting, focus on retention.

60% of clients doing OK: Pivot messaging around how businesses are working now.

2. Preserve optionality through scenario planning

Until you have a better sense of where the market is heading, Dan Hockenmaier (founder of Basis One) wrote an incredibly insightful take on how to plan through uncertainty:

Job #1 is to build and understand a worst case scenario. What would happen if you had to sustain 6 months of zero revenue, and 18 more without the ability to profitably acquire new customers?

However, it is also about understanding the true upside case. For all the immediate pain, I suspect many tech companies will come out of this stronger. Legacy competitors that rely on channels like brick and mortar or outside sales or even harder hit. Consumer behavior shifting rapidly, leading to lots of discovery and trial (if not much purchasing yet). And many customer acquisition channels are currently less competitive, including CPMs that are down ~50% in many cases. All of this means that for many businesses, by 2021 or 2022, the upside case is better than your pre-crisis forecast.

Before you know which scenario you’re in, it’s about preserving optionality. For most companies this means cutting spend to extend runway, and balancing that with keeping as much of the team in place as possible to be able to execute. And it means maintaining trust with your customers by not making knee-jerk changes to policy or pricing.

Similarly, David Rhodes and Daniel Stelter at HBR suggest:

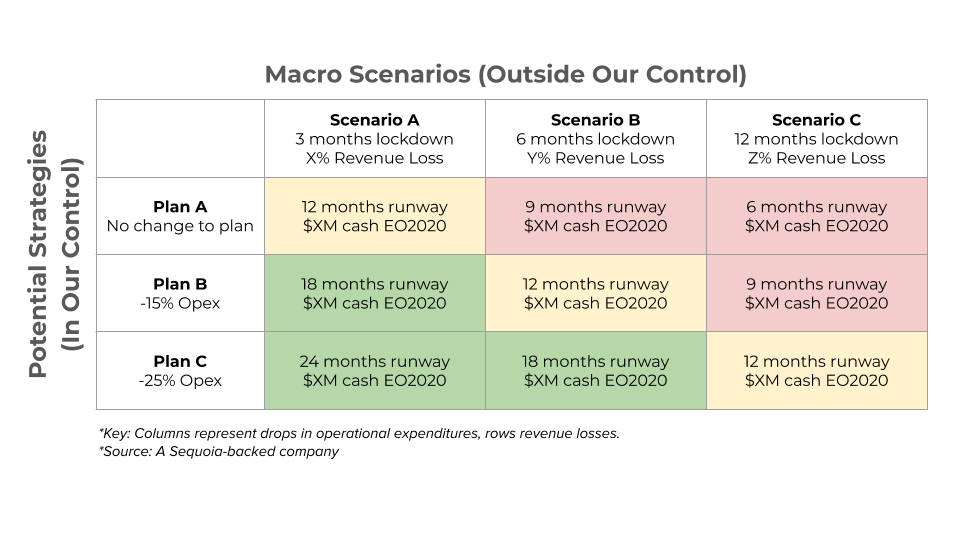

As an economic crisis evolves, sketch out at least three scenarios—a modest downturn, a more severe recession, and a full-blown depression, as defined by both duration and severity. Consider which scenario is most likely to unfold in your industry and your business, based on available data and analysis….

Next, determine the ways in which each of the scenarios might affect your business. How would consumers’ limited capacity to borrow reduce demand for your products? Will job insecurity and deflating asset prices make even the creditworthy increasingly reluctant to take on more debt? Will reduced demand affect your ability to secure short-term financing, or will weak stock markets make it difficult to raise equity? Even if you are able to tap the debt and equity markets, will higher borrowing costs and return requirements raise your cost of capital?

And finally, Sequoia offers a handy matrix to think through your scenarios:

3. Create an incident response team

Operationally, Elena Verna (growth advisor) advises that every company create an “incident response team” with the following attributes:

Assign one person as DRI

Give them full capacity to change anything that needs changing

Blow up your OKRs. Cut initiatives. Set new priorities, tops-down. Don’t just keep the train moving in same direction.

Review every single channel (e.g. paid ads, automated emails, landing pages), removing pictures of people in crowds, hanging out in public, etc.

Have daily standups with the team, reviewing performance and market changes

The most important thing is that you move really fast. Fail fast. Win fast. Don’t wait. One day today is worth a month later.

The Harvard Business Review has a similar, broader recommendation:

Beware of bureaucracy. Assembling a small trusted team and giving them enough leeway to make rapid tactical decisions is critical. Overly managing communications can be damaging when each day brings significant new information to light. Use the clock speed of external events as a guideline for pacing the internal process, rather than starting with the latter as a given.

A living digital document can enhance speed by avoiding the rigamarole of issuing and approving multiple documents, and also reduces risk, since it can easily be updated or withdrawn as necessary. Furthermore, distinguishing clearly between facts, hypotheses, and speculations can help in communicating a fuller and more nuanced picture.

And if you’re fortunate enough to be in a good spot, Cyan Banister (Partner at Long Journey Ventures) encourages you to think ahead:

Right now is a really good time to have a battle strategy plan to build a moat, so that when you come out of this it’s kind of like aha!, here’s what I’ve been working on this whole time, and now we’re ready to seize the market. If you have the runway, and the ability to do this, start thinking about what the new normal looks like and how you can seize the opportunity now, for when things start to come back to normal. Rather than focusing only on the nitty-gritty of the day-to-day.

4. Make sure you have enough cash

From Sequoia:

Cash runway. Do you really have as much runway as you think? Could you withstand a few poor quarters if the economy sputters? Have you made contingency plans? Where could you trim expenses without fundamentally hurting the business? Ask these questions now to avoid potentially painful future consequences.

Fundraising. Private financings could soften significantly, as happened in 2001 and 2009. What would you do if fundraising on attractive terms proves difficult in 2020 and 2021? Could you turn a challenging situation into an opportunity to set yourself up for enduring success?

Headcount. Given all of the above stress points on your finances, this might be a time to evaluate critically whether you can do more with less and raise productivity.

Capital spending. Until you have charted a course to financial independence, examine whether your capital spending plans are sensible in a more uncertain environment. Perhaps there is no reason to change plans and, for all you know, changing circumstances may even present opportunities to accelerate. But these are decisions that should be deliberate.

From David Rhodes and Daniel Stelter at HBR:

The aim here is to ensure that your company has adequate cash flow and access to capital. Not only does a lack of liquidity create immediate problems but it also is critically important to your ability to make smart investments in the future of the business.

Consequently, you need to monitor and maximize your cash position, by using a disciplined cash management system, by reducing or postponing spending, and by focusing on cash inflow. Produce a rolling report on your cash position (either weekly or monthly, depending on the volatility of your business) that details expected near-term payments and receipts. Also estimate how your cash position is likely to evolve in the midterm, calculating expected cash inflows and outflows. You may need to establish a centralized cash management system that provides companywide data and enables pooling of cash across business units.

5. Adjust messaging and positioning

Make sure to review all of your external messaging immediately. Not only for things that will turn people off, but also for opportunities to leverage the current mindset.

Kamo Asatryan (CEO of Primer) shares:

We’re seeing early results showing that “Staying home?” - type messaging is resonating with consumers and driving costs down further. We recommend testing this kind of time-sensitive messaging along with your top-performing creative. Here are five to try:

“Working from home?”

“Delivered to your door”

“Made & Shipped in the US” (focus here is on supply chain flexibility)

“[Healthy or Fun activity] from home!”

“Skip the store”

And Elena Verna suggests:

See if you can reposition yourself in the market right now focusing on remote work and solution for work from home environment.

Test it on social quickly, give it a couple of iterations, and then go. Look at Google Trends for keywords that are skyrocketing.

Get inspiration from what else is happening in your category. What are your competitors trying?

If you are targetting billboards, not a good idea. Pivot to go to digital channels. Everyone is online right now.

Look for new use cases that may have been unlocked, or new personas. Everything may have changed.

Don’t include “covid” in the messaging, instead come in with a solution to the problem the user is facing. Make sure you don’t look like you are trying to profit from covid.

In addition to just messaging, try to remove as much friction. Double down on fremium offers, extend trials, give credits, and short-term subscription commitments. Show empathy to your markets. People need human connection to companies.

6. Take advantage of the lower ad costs

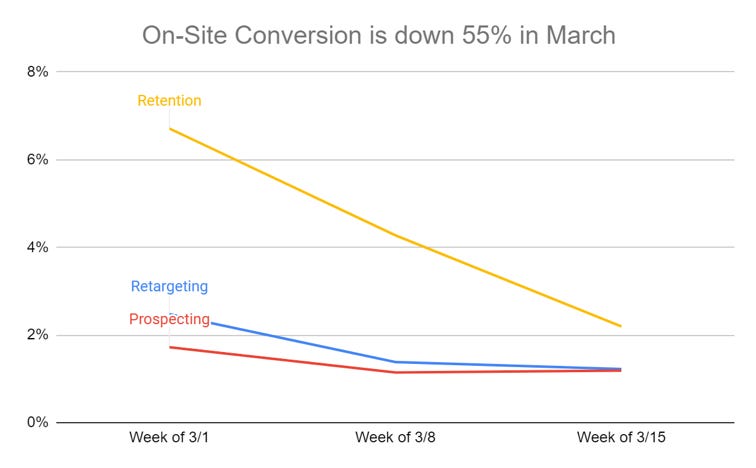

The folks at Social Fulcrum put together amazing data about the big shifts they are seeing in social ads:

Facebook CPM is down 45%, dropping 20% each week, since start of March. It hasn’t yet reached bottom.

CPC is down 40%

CTR on ads have not changed

However, on-site conversion is also down 53% (more people browsing, less people buying)

As a result overall, CAC is up actually up 28% (mostly due to on-site conversion being way down)

Advice:

Shift spend towards prospecting, away from retention — According to the data, returning users are converting the worst.

Change your creative — Eliminate people doing things in public.

Messaging — Focus on safety and convenience, “rapid delivery”, “ships from US”

Promos - Keep it simple, like “20% off sitewide”

Similarly, the folks at Primer are seeing CPM costs go down as well:

“We have seen a 23% decrease in CPMs across our partners’ campaigns in the past 7 days. Individual brands have seen CPM decreases as much as -40% in the past week.”

7. Take care of your customers

Russell Glass (CEO of Ginger) offers a couple of suggestions for keeping your customers happy and onboard:

Look for partnerships where you can help the customer with what they’re trying to do. Can you help customers drive revenue in new way? If so, they’ll be more likely to stick with you.

Offer short-term contacts (e.g. 30-day outs), with no obligation. You can get out any time. People can’t plan, so don’t try to make them.

Patrick Campbell (CEO of ProfitWell) shares a few more suggestions:

Offer customers free extra months, instead of a lower % cost

The game right now is of cash flow, so get deals moving

Stay on top of payment failures — engage lapsing customers personally

And Brian Balfour (CEO of Reforge) shares an analogy (originally inspired by Chris O’Donnell) about Lakes and Rivers:

Lakes are your free active subscribers, your freemium users. Generally, you send them down the stream to convert into paid users. If you have cash, now is the time to fill the lakes. Remove all of the friction you can to fill these lakes.

For example, Loom massively expanded what you get in the free plan, and cut cost of the paid plan in half. What they are doing is removing friction to build habit with the product now, and as this settles down, that stored monetization potential will pay off.

8. Take care of your team

Finally, make sure that you think about your team just as much as you are thinking about your business.

Clear communication internally is critically important. Any thoughts you’re having in your head — more than likely someone else in the company is thinking about it. Not talking about it creates more uncertainty and stress.

— Russell Glass (CEO of Ginger)

Employees will likely be exposed to conflicting information and feel anxious or confused about the best course of action. Be sure to communicate policies promptly, clearly, and in a balanced manner. Furthermore, communicate contextual information and the reasoning behind policies so that employees can deepen their own understanding and also take initiative in unanticipated situations, such as employee holidays in a restricted location or how to handle contractors.

Take care of your people — be transparent, be vulnerable, be open about how worried you are and what you are considering.

Lack of information creates a lot of uncertainty and anxiety. Have your team be together with you.

And if you are benefiting from this timing, consider doing some social good. This is the time to offer free offerings to schools and non-profits that are dealing with Covid-19. These are always good brand marketing opportunities, but it’s also important to do this during these times.

What comes next

To close, one additional snippet from Dan’s invaluable post about how the recovery may look.

The recovery will not be evenly distributed

The reality is that different industries and companies are going to see different shapes of recovery. There are two questions to ask yourself to help understand which case you will see.

First, have many of your customers actually churned, or just gone dormant?

The more it is the former, the more like you are to see a U or even L-shaped scenario. This is the unfortunate reality for many businesses that serve SMBs, for example, because many of them do not have the cash to survive a month without revenue.

Second, has the underlying customer behavior actually changed?

This may well be true in the extreme negative cases such as travel and events, and in the extreme positive cases such as online education and food delivery. We’ll certainly see some regression to the mean, but new patterns are getting hardwired as we speak. These businesses are more like to see the good or bad version of an L-shaped recovery.

If you have any other advice to share or learnings you’ve found useful, please share in the comments below. 🙏

Full list of references for the snippets used in this post:

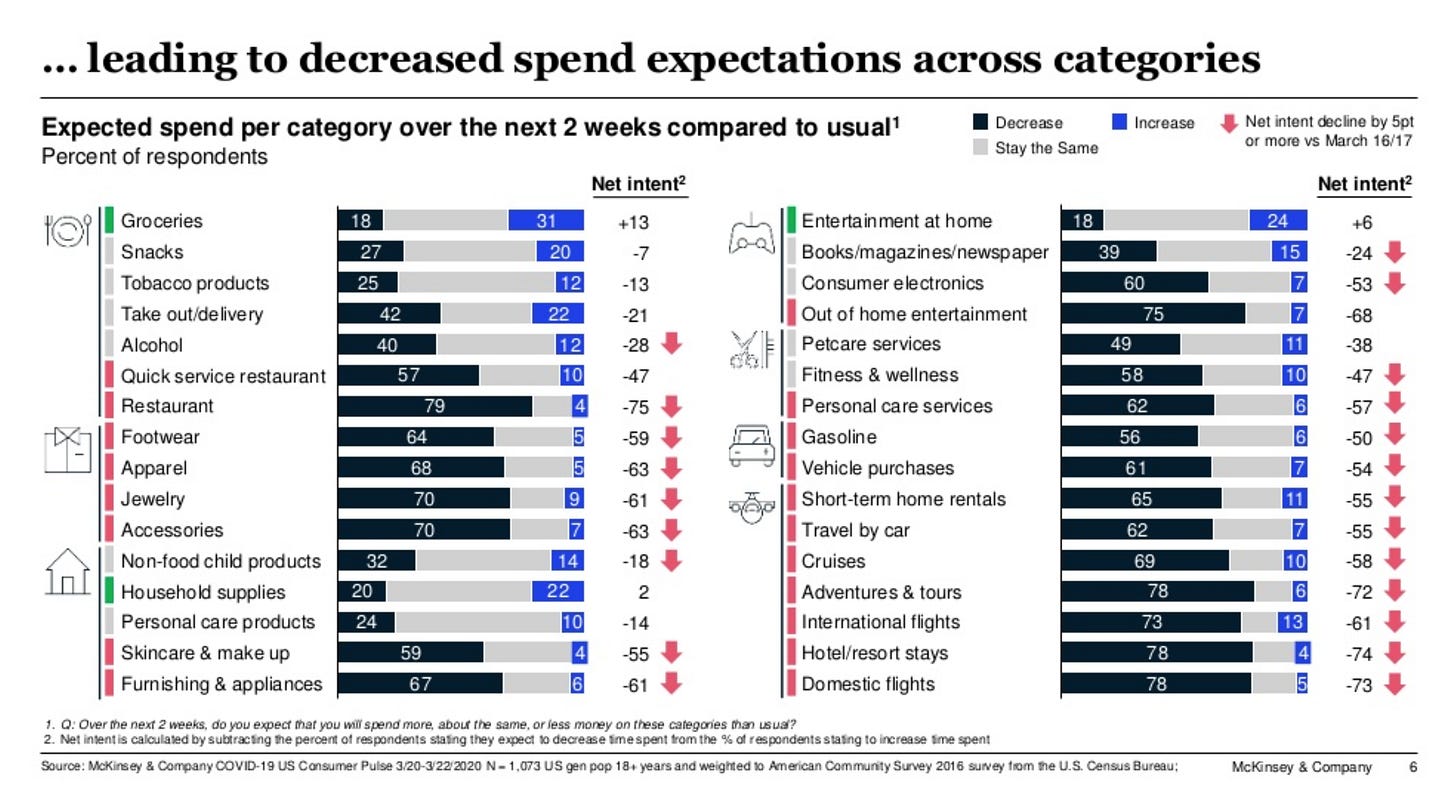

McKinsey survey: US consumer sentiment during the coronavirus crisis

COVID-19 and the Creative Economy: Takeaways from Patreon’s Data Science Team

BCG consumer spend pulse #1: COVID-19 impact on US vs. Seattle

Inspirations for the week ahead 🧠

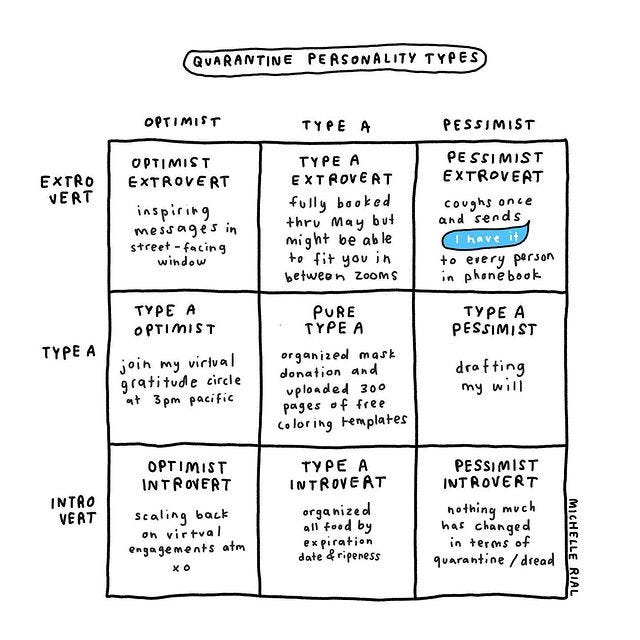

Laugh: Quarantine Personality Types (courtesy of my very talented wife)

Listen: Supercalifragilisticexpialidocious with some Coronavirus inspired lyrics

Read: “The simple truth is we are a fantastically social species and threats only fuel our instinct to pro-social behavior”

If you’re finding this newsletter valuable, consider sharing it with friends, or subscribing if you aren’t already.

Sincerely,

Lenny 👋

I've read a lot of posts recently on social media, from many different personal brands. This compilation is a hidden precious gem, and deserves wide recognition. Thank you for putting this together 💙