This Week #15: When should a SaaS startup raise money 💰

Hello and welcome to another edition of my weekly newsletter 👋

Each week, I’ll tackle reader questions (keeping your name and company anonymous) about building product, driving growth, and anything else that’s stressing you out at the office. Send me your questions (just reply to this email or DM me) and in return I’ll give you free actionable real-talk advice.

If you’re finding this newsletter valuable, consider sharing it with friends 🤜🤛

Q: We’re a SaaS startup with a three-person team. We’re at a stage now where we’re onboarding a few new customers per week and things are picking up. When you were building Localmind – at what point did you put your foot down on the hiring? We’ve raised some angel money before but not sure when it’s right to raise more. We want to move as fast as possible but don’t want to risk quadrupling the burn rate only to run out of money. It would be great to know your thoughts and what you would suggest regarding the right timing on growing the team and balancing speed vs cost.

At Localmind, we never got anywhere near to this stage (late 2000’s consumer social, location, mobile-based businesses FTW 🥴), but there’s a fairly clear guideline for when any business should raise meaningful money, start hiring, and focus on growth: after you’ve found product/market fit.

“In general, hiring before you get product/market fit slows you down, and hiring after you get product market fit speeds you up. Until you get product/market fit, you want to a) live as long as possible and b) iterate as quickly as possible.”

— Sam Altman

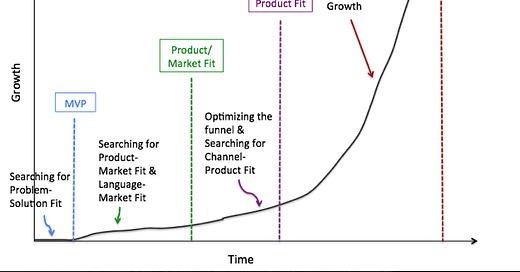

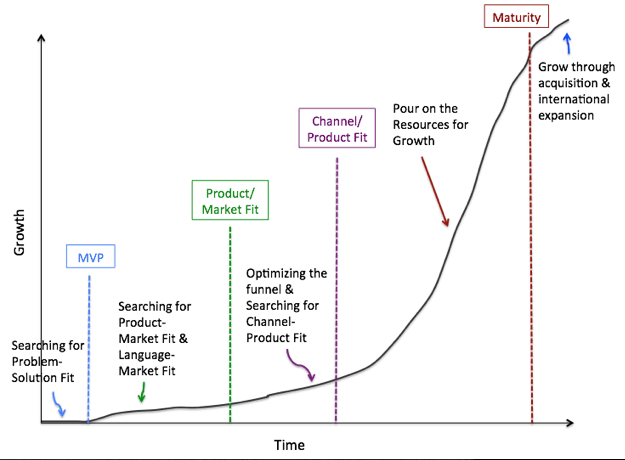

Every successful business goes through roughly three stages:

Search for product/market fit

Growth <— Best to raise money here

Maturity

Source: Morgan Brown

In stage one, you are trying to figure out if anyone even wants what you’re building. Though many companies raise a bunch of money at this stage, it’s high-risk, since you are going to spend it looking for PMF (building, iterating, learning, repeating). As a founder, if you can avoid raising money here you’ll be better off both in terms of dilution, and time pressure.

“One of the most common ways that startups die is premature scaling, a term first used by Steve Blank. A business is scaling prematurely if it is spending significant amounts of money on growth before it has discovered and developed PMF.”

In stage two, when you’re fairly confident you’ve got PMF, your focus shifts to getting your product into people’s hands. This stage is where funding can be most valuable — with accelerating hiring, allowing you to invest in paid growth channels and/or a sales team, and with practical things like larger office space. But be very thoughtful about how much you raise, who you raise from, and what this means for your business.

“When should a profitable company raise capital, if ever? The answer is the same for all businesses regardless of financing history: Raise capital when you are confident that you can use it to attain a higher growth rate and the higher growth rate is worth a trade-off in dilution. Higher growth rates increase the value of a business. Higher growth rates fetch greater multiples.”

Here are three excellent guides for thinking through your tactical fundraising strategy:

At the core, as the quote above suggests, the key question you need to think through is: what do your new hires (and spending) need to achieve in order for the raise to become a net win for your business? And how confident are you that this will happen?

Good luck!

Inspirations for the week ahead 🧠

Read: A flight-tested framework for effective goal-setting — By me!

Read: The folks at Andreessen Horowitz put out a motherload of juicy marketplace content:

Required reading for marketplace entrepreneurs (Notice anyone you know?)

Four paths to marketplace success (Profoundly insightful)

A rank of the top 100 biggest private marketplace companies (Many surprises)

Watch: Great Talks Most People Have Never Heard by James Clear

That’s it for this week!

If you’re finding this newsletter valuable, consider sharing it with friends (or subscribing if you aren’t already)

Sincerely,

Lenny 👋