Scaling your B2B growth engine

Part seven of my seven-part series on kickstarting and scaling a B2B business

👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career.

Welcome to part seven of our (now complete!) seven-part series on kickstarting and scaling a B2B business 🥳

Here’s an overview of the series so far:

Part 2: How to validate your idea

Part 3: How to identify your ICP

Part 7: How to scale your growth engine ← This post

Let’s do this.

A huge thank-you to Akshay Kothari (COO of Notion), Ali Ghodsi (CEO of Databricks), Andrew Ofstad (co-founder of Airtable), Barry McCardel (CEO of Hex), Boris Jabes (CEO of Census), Calvin French-Owen (co-founder of Segment), Cameron Adams (co-founder and CPO of Canva), Christina Cacioppo (CEO of Vanta), David Hsu (CEO of Retool), Eilon Reshef (CPO of Gong), Eric Glyman (CEO of Ramp), Guy Podjarny (CEO of Snyk), Jori Lallo (co-founder of Linear), Julianna Lamb and Reed McGinley-Stempel (co-founders of Stytch), Keenan Rice (founding team), Mathilde Collin (CEO of Front), Rick Song (CEO of Persona), Rujul Zaparde and Lu Cheng (co-founders of Zip), Ryan Glasgow (CEO of Sprig), Shahed Khan (co-founder of Loom), Shishir Mehrotra (CEO of Coda), Sho Kuwamoto (VP of Product of Figma), Spenser Skates (co-founder and CEO of Amplitude), Tom Preston-Werner (co-founder of GitHub), and Tomer London (co-founder and CPO of Gusto) for contributing to this series. Art by Natalie Harney.

Although we’ve reached the end of this journey, we’re on a journey that never ends. Building a venture-scale business means endless challenges, surprises, and an unrelenting need for growth. I like to think of the startup journey as a huge puzzle board, where every challenge, decision, and opportunity is a piece of the puzzle. My job is to (slowly but surely) fill in this board and help you through every challenge, decision, and opportunity you’ll face.

For reference, here are some puzzle pieces I’ve already put into place to help you scale your B2B startup prior to this series:

On growth and GTM

On sales

On pricing strategy

On fundraising

Today, I’ll answer four additional questions:

What’s a good timeline to get to $1 million ARR?

What are the most common growth channels for B2B startups?

When should you start charging for your product?

What should you charge?

Let’s get into it.

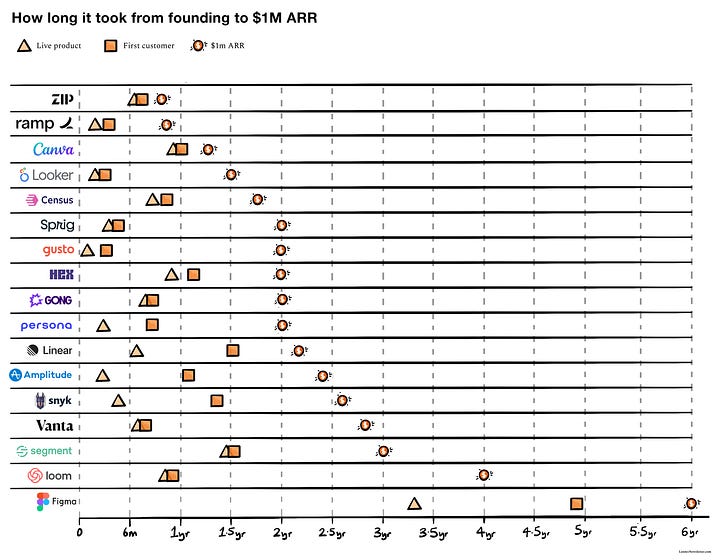

Typical times to get to $1M ARR

On average, it took top B2B startups ~2 years from founding to hit $1m ARR, and roughly 1.5 years after closing their first customer. There are exceptions, like Ramp, Linear, Census, and Zip, that got there more quickly (some within months), and also companies like Loom and Vanta that took 2+ years.

My takeaway is that once you’ve signed your first customer, you should strive to hit $1m ARR within 1.5 years if you want to be on pace with the top B2B companies.

Interestingly, there isn’t a large difference in timelines between companies with large ACVs (e.g. Looker, Gong, Sprig, Vanta) and low ACVs (e.g. Loom, Figma).

Also, in some instances, there’s good reason to push out monetization. In the case of Loom, co-founder Shahed Khan shared, “We didn’t monetize Loom for several years intentionally, as our focus was to become a ubiquitous tool within organizations. Thus it took us four years to hit $1m ARR.” With the recent acquisition news, seems like a good call.

How B2B startups grow as they scale

Broadly, the biggest growth channel for top B2B companies (at least the 20+ I researched) is organic inbound. Essentially, word of mouth. This connects with a key lesson from part five of this series—that strong product-market fit often looks like strong organic growth. That being said, as we saw in part six, eventually 100% of B2B businesses build a sales team.

Below I’ll explore all six B2B growth channels: self-serve organic inbound, sales-assist organic inbound, outbound sales, content/SEO, paid ads, and partnerships. This summary doesn’t get into revenue expansion (e.g. growing revenue from existing customers), since it didn’t come up in my interviews, but this is also a massive growth lever for scaling B2B SaaS companies, and I’ll spend more time here in future posts.

Use this list not as “we should do all of these,” but instead as inspiration for one new channel to explore for your own product. You’re likely already growing primarily through one of the first three channels; ask yourself which of the remaining channels might be a new opportunity.

1. Organic inbound: Self-serve (aka Product-Led Growth)

This channel is simply users hearing about your product from someone else (or being invited) and signing up on their own. No one from your company helps them through the funnel. This isn’t to say salespeople never talk to these leads (check out this podcast episode on product-led sales), but it does mean new customers come primarily from them first trying the product on their own. Companies like Loom, Figma, Segment, Gusto, Hex, and Linear grow primarily in this way.

What this looks like:

“People in trials are checking out with credit cards, without us talking to them.”

“Signing up for Loom after watching someone else’s Loom (typically coworkers), within Slack or in Salesforce, Linear task, or Notion doc.”

“We’ve always had a strong stream of inbound users who had found out about us via our open source work and propelled us through our early revenue milestones.”

2. Organic inbound: Sales-assist

Similar to the above channel, new customers come to you, but in this case, your sales team hand-holds leads through the process. Companies like Looker, Ramp, Vanta, Hex, Census, Persona, and some portion of Amplitude and Segment grow through this channel. The key determinant of whether you go self-service or sales-assist is how successfully new users can get activated without handholding.

What this looks like:

“Our biggest growth channel by far is organic, with visitors to our site clicking the ‘Request a demo’ button.”

“Customer referrals continues to be one of our strongest channels, which funnels into our inbound sales pipeline.”

“All of our growth is inbound, but it’s all sales-touch.”

3. Outbound sales

This is what you think of when you think of sales-led growth—your sales team reaches out to prospects, pitches them, and closes them. Companies that grow primarily through this channel include Gong and Zip, along with a meaningful portion of growth for Ramp and Segment. I’ll be doing more writing on this topic in the coming months, so stay tuned.

4. Content/SEO

A surprisingly popular growth channel for top B2B companies is content. Companies like Vanta, Amplitude, Figma, Persona, and, famously, HubSpot have all found success using content (aka SEO) to grow. I’ve covered this topic in depth previously, so go read this if you’re looking to invest here.

5. Paid ads

They may be boring, but paid ads work. For B2B, this means running ads on Google, Facebook, and LinkedIn, along with the occasional ad on podcasts, newsletters, and other less-scalable channels. Companies that have found success here include both large (Figma and Amplitude) and smaller (Vanta and Census). For advice on running paid ads, here’s a good podcast episode to check out.

6. Partnerships

Partnerships: huge if successful, massive time suck if not. This is a meaningful growth channel for companies like Census, Hex, and Zip, but as one founder shared, “We have a big channel partnership with Snowflake, and though this doesn’t drive a big percentage of our leads, it does help to have that relationship.” I’ve written about channel partnerships before, so go read this if you’d like more examples and advice.

A few additional takeaways

Most of your growth will come from one of the top three: inbound self-service, inbound sales-assist, or outbound sales. Spend most of your time optimizing that channel.

No matter how you start, you’ll be building a sales team. It’s a question of when, not if.

Creating content (e.g. blog posts, LinkedIn posts, viral tweets, a great podcast) seems to be effective for a number of companies, so it’s worth exploring. But think about the system that can allow this to scale, versus one-off efforts. Think engines, not turbo boosts.

Be careful about forcing PLG. Here’s Ali Ghodsi (founder and CEO of Databricks)’s cautionary tale:

“The whole vision of Databricks was we don’t want to have sales in the company. It’s going to all be product-led growth. So it’s a hundred percent product-led-growth motion. And in 2015, we kind of doubled down on it. We actually said, ‘Let’s do what Amazon did. Let’s just make it really slick, and you swipe your credit card and you can start using this stuff.’ We called it the zero-touch effort. We were going to touch the customers zero times from a sales perspective. No human needed to touch the customer. We’re very excited about that and we built it all, we automated it all. And I think around Q2 of 2015, we told sales, ‘Stop engaging with the customers. This is going to be zero-touch. Focus all your attention on automating this stuff and let’s set it up for that kind of motion.’

And actually, revenue flatlined. Revenue was growing, and then in Q2, Q3 of 2015, it started flattening. So around Q4 it was starting to become kind of clear that, okay, this product-led-growth thing—nice story, but in practice, it doesn’t really work. Which is actually, by the way, my view. I think for all practical purposes, PLG doesn’t work. It’s a ‘don’t try it at home’ kind of thing. Maybe it works for Atlassian. Maybe if you can swipe a credit card and use the product in five minutes, it’ll work. But if you think this is how you can sell to enterprises, without a sales force, good luck.”

When and how much to charge

These are the four key lessons that came up again and again when I talked to founders about their pricing strategy: