Pulling back the curtain on the magic of Y Combinator

A first-of-its-kind deep dive into the data to see what’s really working for the industry’s biggest incubator

👋 Welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Lennybot | Podcast | Courses | Hiring | Swag

Annual subscription includes a free year of Perplexity, Notion, Superhuman, Linear, and Granola, along with access to the entire 5-year back catalog and a thriving members-only Slack community. Subscribe now.

To honor the final day you can apply to Y Combinator’s first-ever Spring batch (i.e. X25), I teamed up with past collaborator Palle Broe on the most in-depth and intriguing analysis you’ll find anywhere of the world’s most successful startup incubator. Palle spent over 100 hours digging through all available public data to answer questions like:

How has YC performed over the past 20 years?

What are YC’s biggest winners?

What impact does joining YC have on your startup?

What does YC look for in startups?

What is YC betting on most going forward?

If this post inspires you, it’s not too late to start your application and apply to YC. Apply here by 8 p.m. PT tonight!

For more from Palle, make sure to subscribe to his newsletter, Rule of Thumb, and follow him on LinkedIn. Learn more about Y Combinator here.

Y Combinator (YC) is widely regarded as the most successful startup accelerator and the top choice for world-class entrepreneurs. For those new to the startup world, Y Combinator is like a boot camp for startups. Selected founders receive $500,000 in seed funding in exchange for roughly 7% equity. Four times a year, founders are immersed in a three-month cohort, or “batch,” with about 125 other startups, which are sorted into groups and mentored by successful founders. It’s an exclusive program—with an approximately 1% acceptance rate—offering founders a powerful network, future funding opportunities, and instant credibility.

The evidence is clear. Roughly 4.5% of YC companies become unicorns (in contrast to the 2.5% outcome for other venture-backed seed-stage startups), and around 45% of companies go on to raise a Series A (higher than the 33% average). So far, YC has funded more than 90 billion-dollar companies. Top YC companies include Stripe, Airbnb, Coinbase, and Reddit.

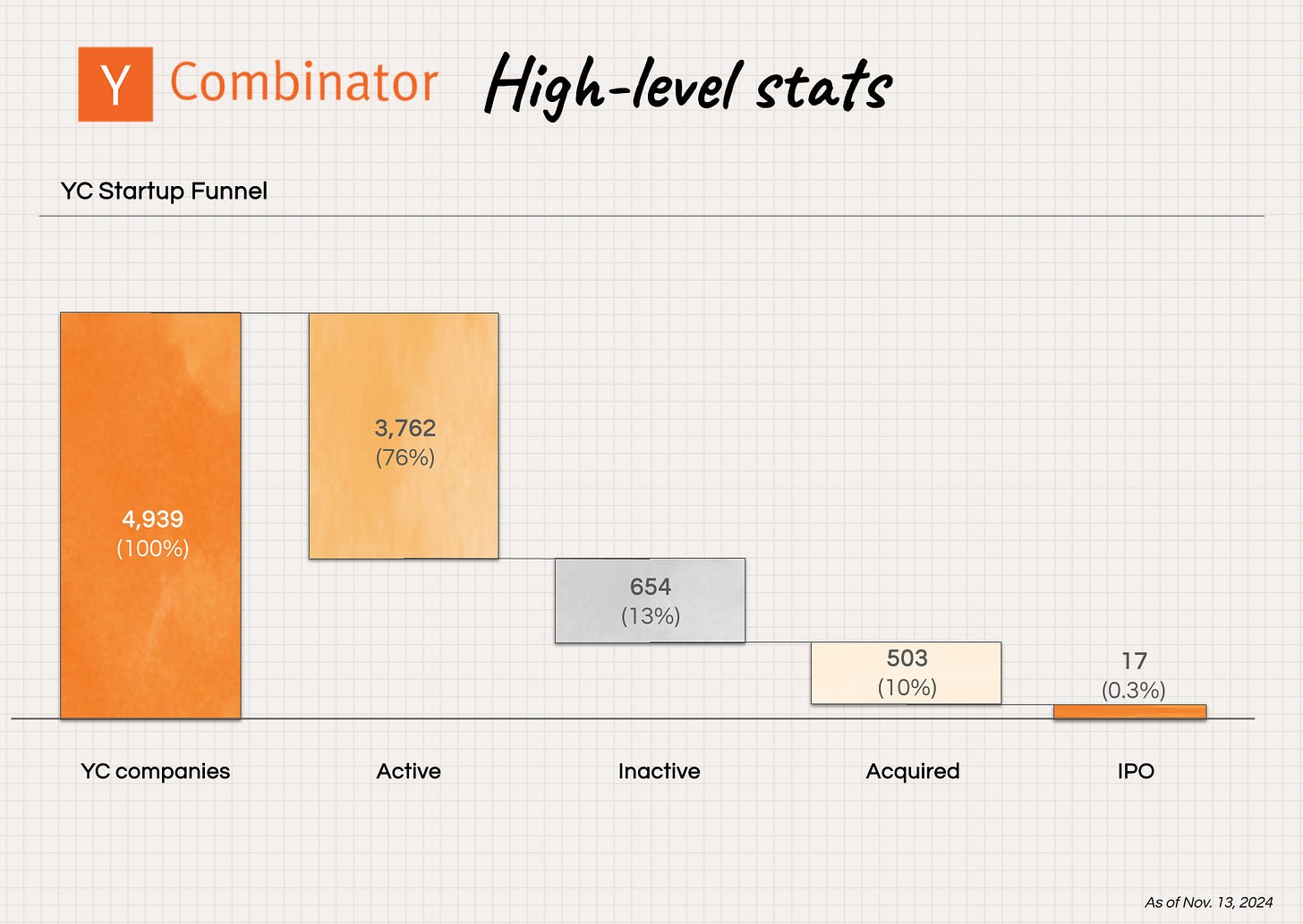

But what does the data say about the impact of YC and the success of their bets? We tried to demystify the giant by reviewing the 4,939 YC companies so that startup founders, investors, and others can see what’s really going on—and maybe learn from the successes or trends.

There was a lot that was surprising in the data. But one theme throughout was that the magic of the incubator appears to be in picking the best founders, understanding trends, and the process within YC, not about repeating the successes of one particular startup profile. Read on to learn more about what we uncovered.

Key takeaways

YC has gone from being a Consumer investor to primarily a B2B investor. Consumer companies have resulted in over $200 billion of market cap, while B2B companies are currently privately valued at some $170 billion and are on the rise.

Based on batch profiles, founders are betting on AI (specifically, B2B AI) to be the next big thing. The most promising subcategories include “Engineering, Product, and Design,” Infrastructure, and Sales.

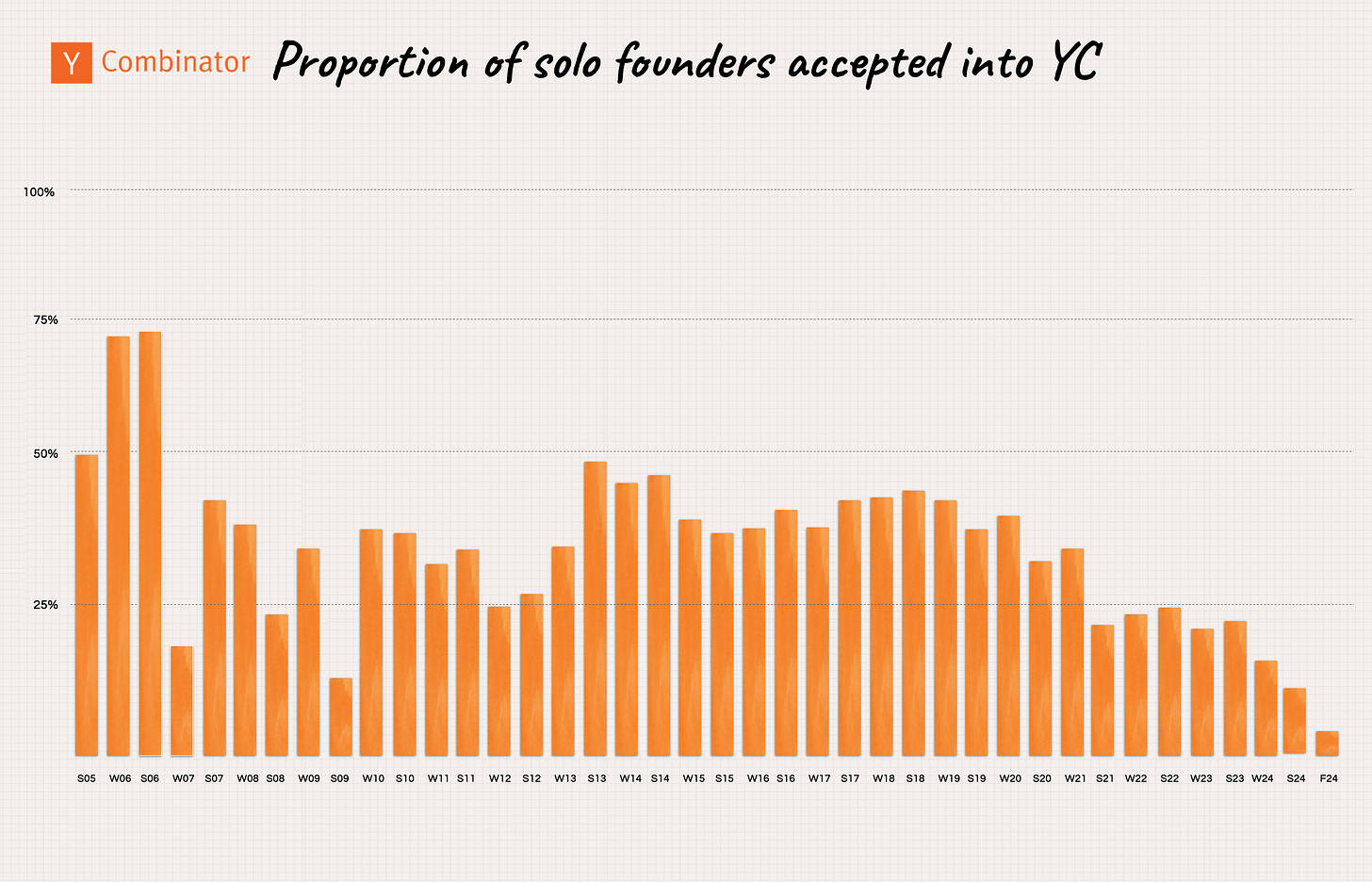

Solo founders are at a disadvantage. Although solo founders are encouraged, the data does show a steep decline in the number of them accepted to YC.

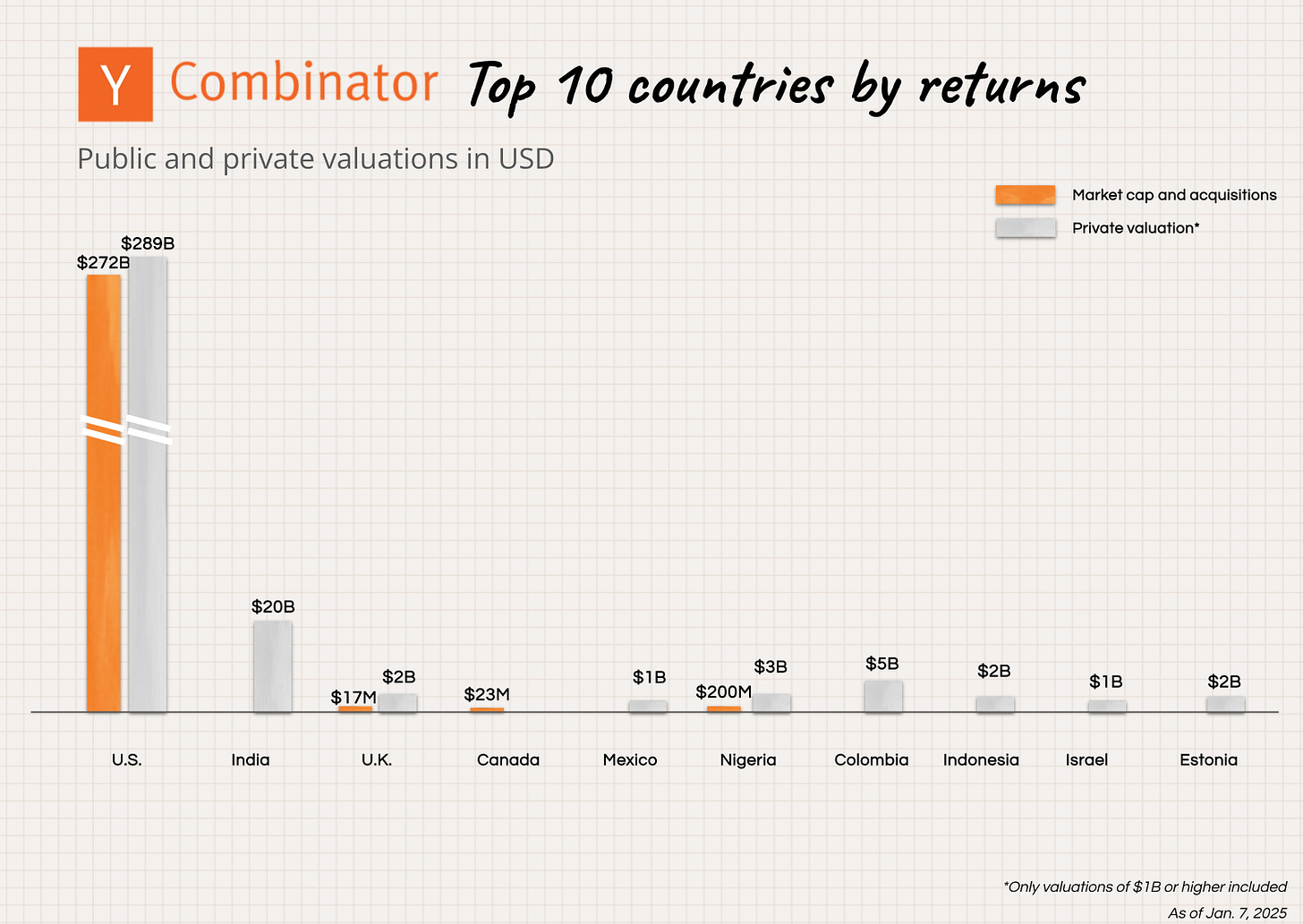

Success has so far been driven by U.S.-founded companies. More than 70% of the startups have been founded in the U.S., and to date, 99% of returns have come from the U.S.

The durability of YC companies is significantly higher than that of the average startup. More than 50% of companies are still alive after 10 years (vs. 30% average).

The chances of startup success are higher with YC. 45% secure Series A (vs. 33% average), 4% to 5% become a unicorn (vs. 2.5% average), and 10% achieve an exit.

The investors in YC companies are the “crème de la crème.” Tier 1 VCs frequently invest in YC companies, and some have made several hundreds of investments.

Methodology

Sources: Y Combinator, Harmonic, and Crunchbase.

Included 4,939 YC startups from the first batch in 2005 (S05) to the fall batch of 2024 (F24). The one-off education-focused batch (IK12) not included.

Not considering YC continuity investments.

Data is as of December 10, 2024 (or otherwise, as stated on the graphs).

Some companies do not disclose valuation or acquisition price, so sometimes the data will not contain all companies. Treat the numbers below as directional, not as exact figures.

What does YC success look like?

Around 10% of YC companies achieve an exit

As of today, 17 companies have been backed by YC and gone public. Another 76% are still actively pursuing an exit. But one impressive fact is that only 13% of companies have gone out of business.

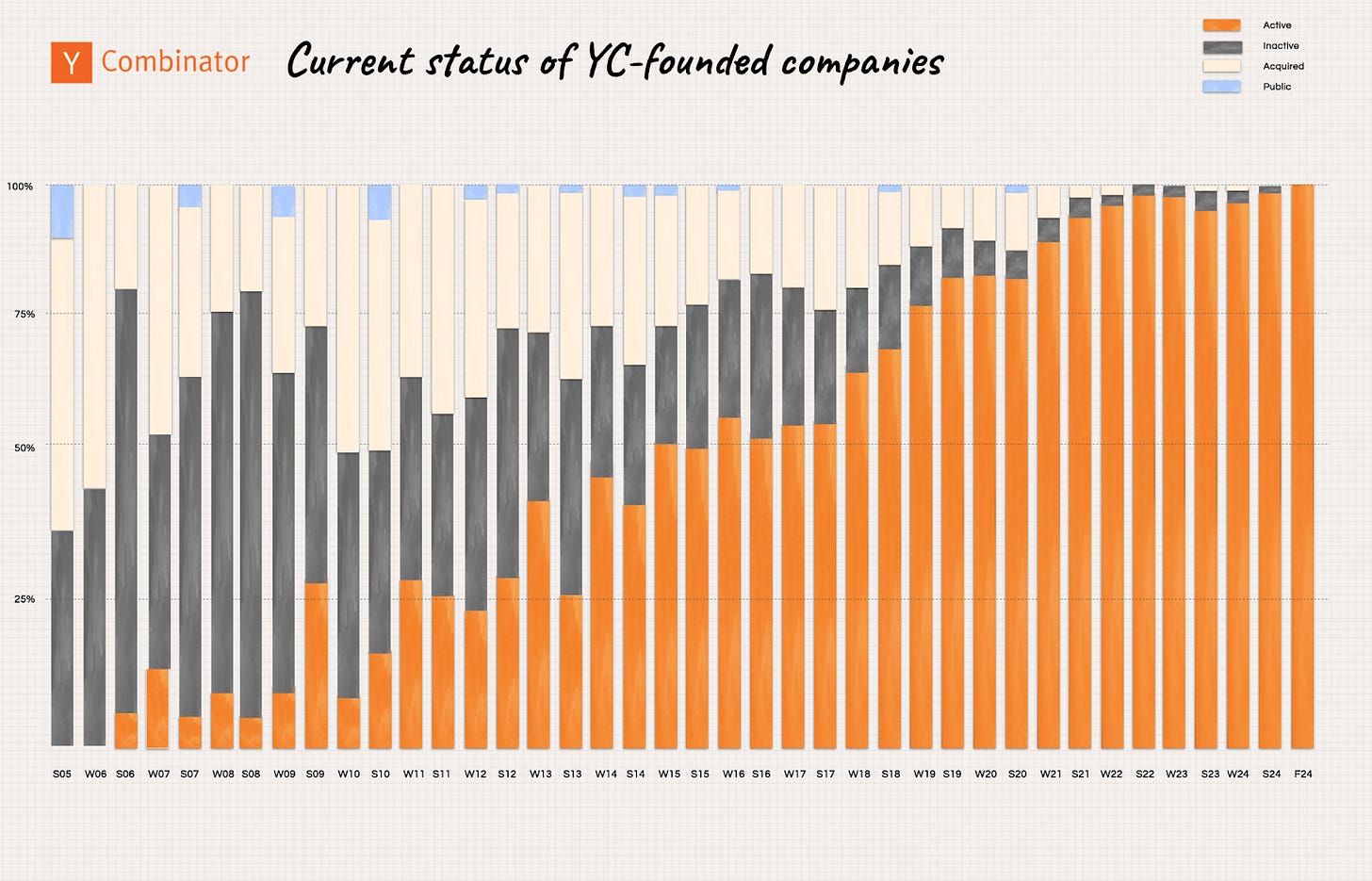

More than 50% of companies are still active after 10 years

YC companies are more durable than other startups, which have an average lifetime of around five years. Batch W15, which is now 10 years old, still has more than 50% of its companies actively operating. All other batches since then have more than 50% of companies still operating.

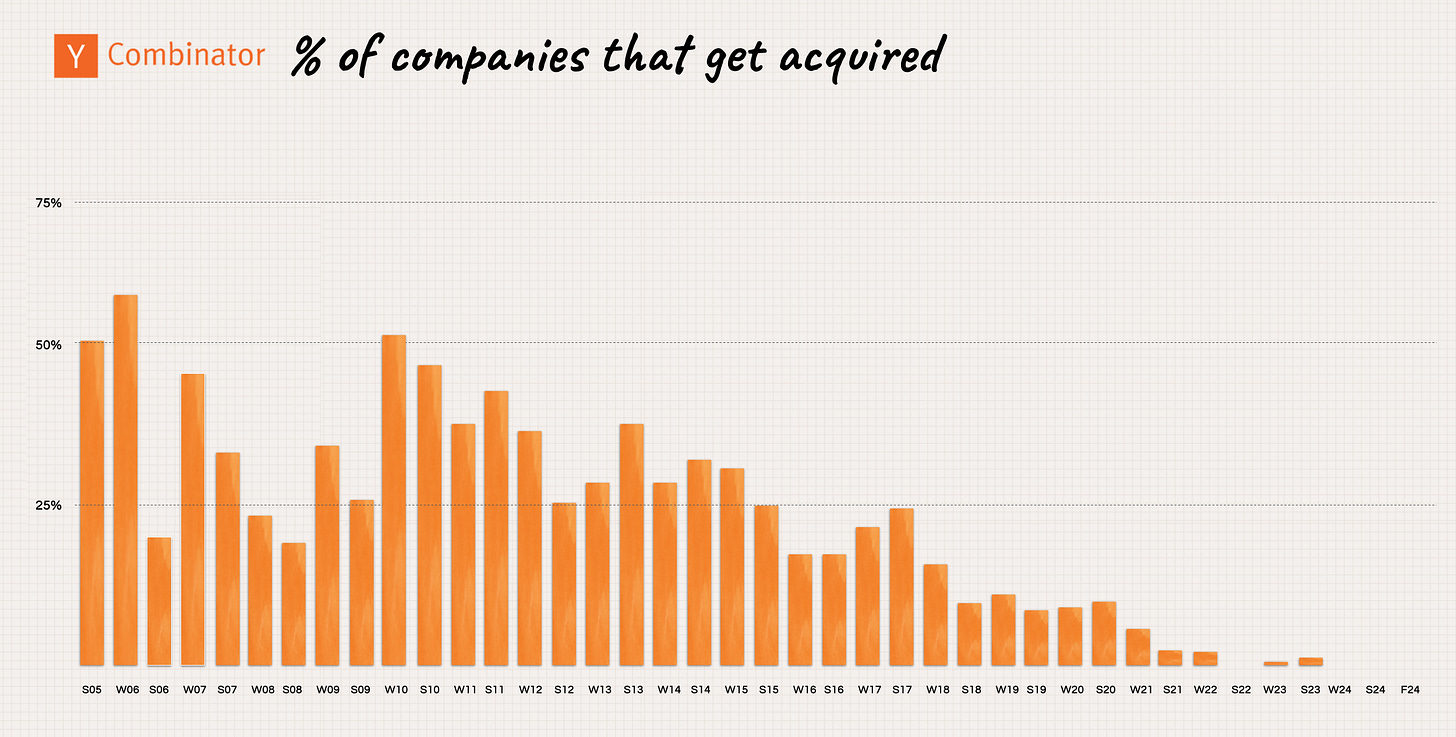

Between 25% and 50% of companies get acquired after 10 years

A measure of success for any incubator or investor is the number of companies that achieve a liquidity event, either via an IPO or an acquisition. And no one does that better than YC. When you look at the mature batches, we are seeing between 25% and 50% of companies getting acquired. This speaks volumes about the quality of companies in YC. This is in contrast to the 15% of global companies that get acquired if they have raised at least one round of funding.

What are the biggest YC winners?

Consumer companies have driven the majority of YC returns

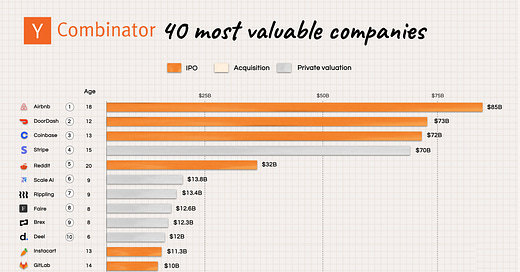

By far the largest wins for YC have come through some of their early consumer-focused companies. As a matter of fact, the four companies with the highest market capitalization are consumer companies: Airbnb, Coinbase, DoorDash, and Instacart. It’s no secret that technology startup outcomes follow a power law distribution, and that is also very much the case for YC, where the top four companies—Airbnb, DoorDash, Coinbase, and Instacart—account for more than 84% of the market value created.

More than $600 billion has been created in market value

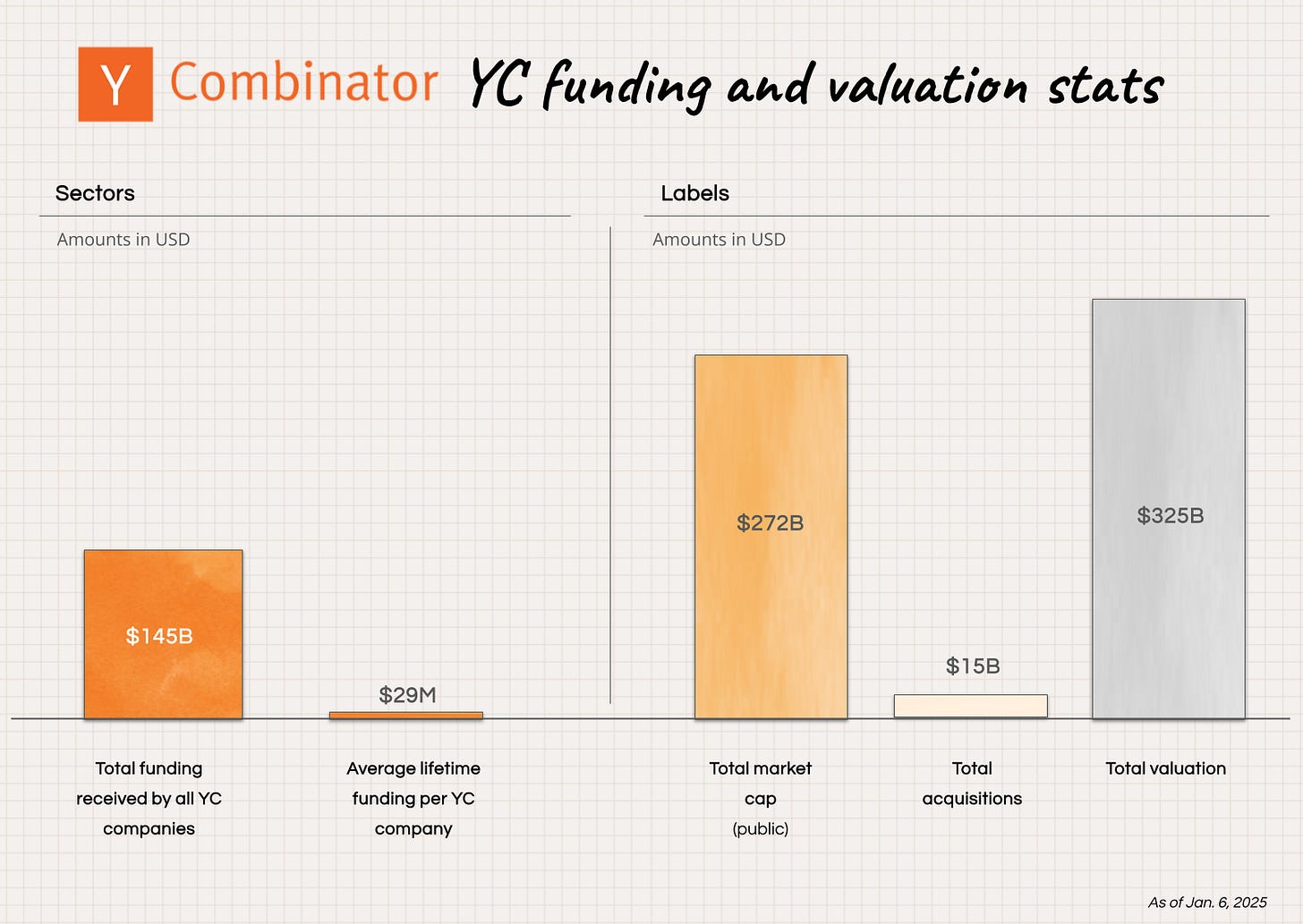

YC companies attract a lot of funding. In total, more than $145 billion has flowed into the startups that were part of YC. This investment has led to the creation of more than $300 billion in market value, and with the existing private companies, this amount could double to more than $600 billion in the future (once private companies exit). Although acquisitions are the most common path for YC startups, they have “only” brought in $15 billion.

Consumer companies top the funding charts as well

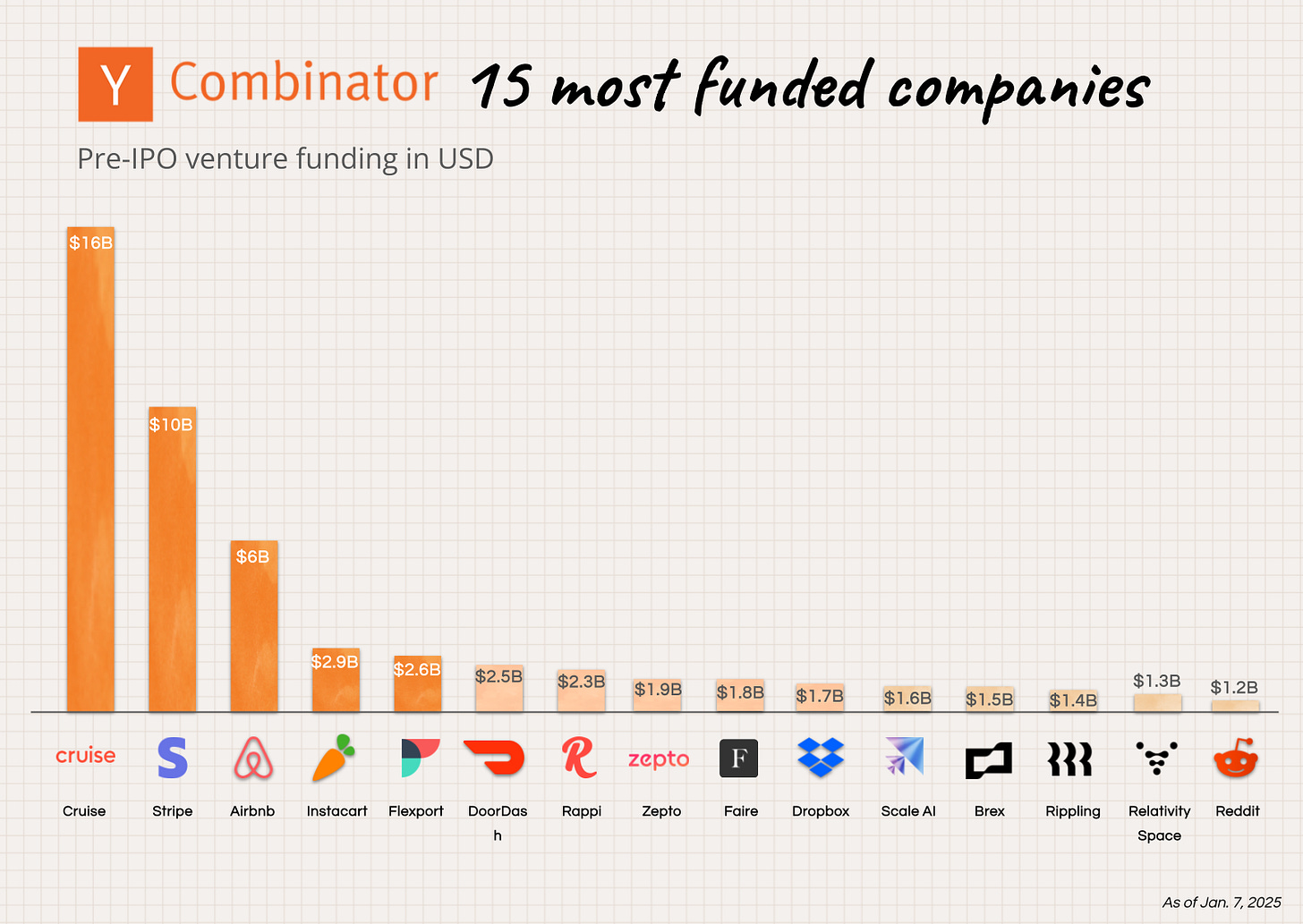

Cruise and Stripe are the two most well-funded YC companies ever. Cruise requires large amounts of capital due to the expenditures required in the autonomous vehicle industry, and Stripe has been focused on blitzscaling their product globally—also requiring a lot of funding. Two-sided marketplaces such as Airbnb, Instacart, DoorDash, and Rappi are notoriously expensive to get started and require subsidizing one side of the marketplace.

Stripe is the next big win for YC

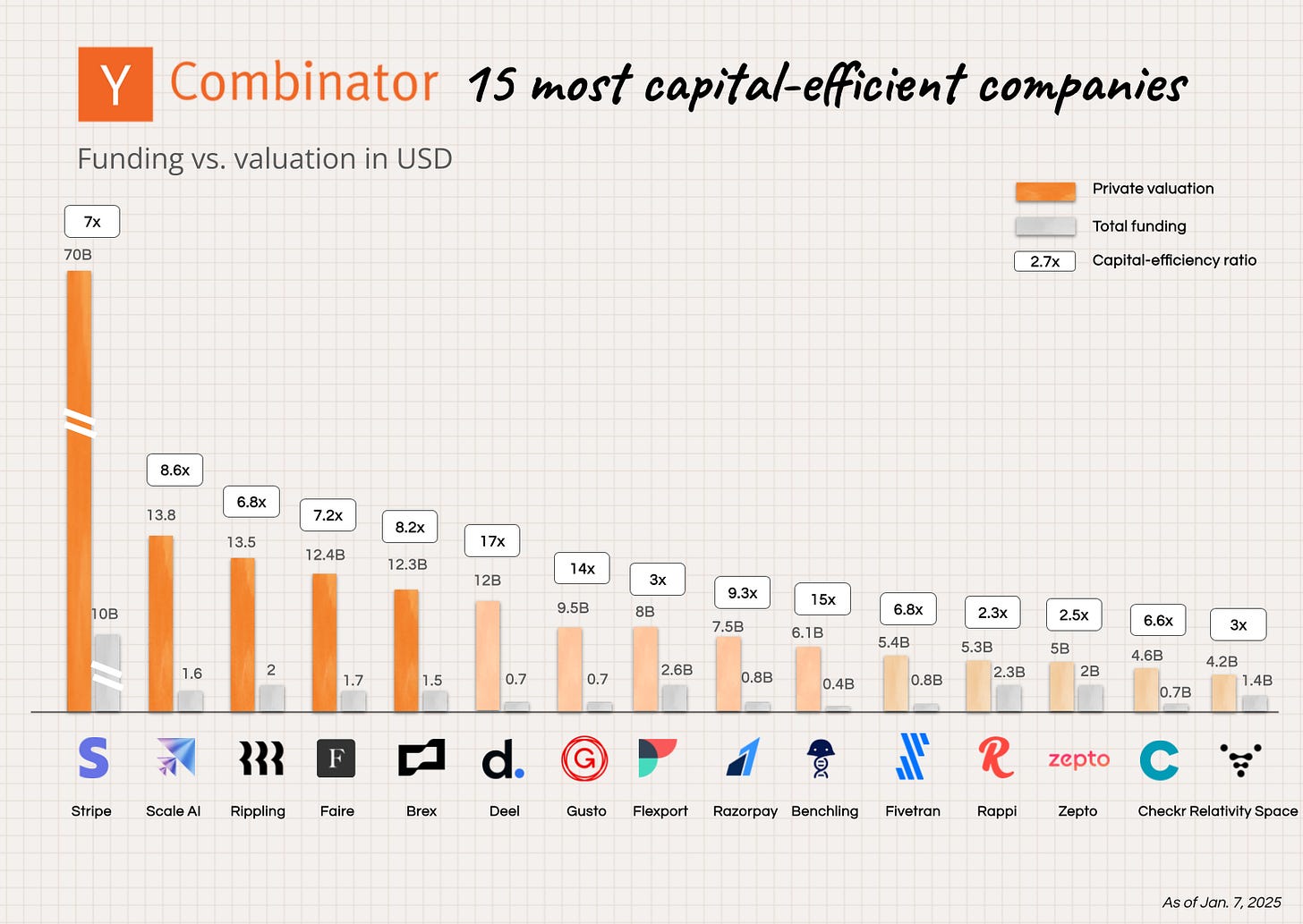

Currently sitting at $70 billion in valuation and estimated to go public in the next few years, Stripe is gearing up to have one of the largest-ever outcomes for YC. Companies riding the AI wave such as Scale AI have seen a rapid increase in valuation and are likely to further benefit from the tailwinds, which could result in even higher valuations in the coming years.

Below you can see the capital efficiency of each of these private companies. That is the amount of funding relative to their valuation. Deel, Benchling, and Gusto are showing particularly strong capital efficiency ratios.

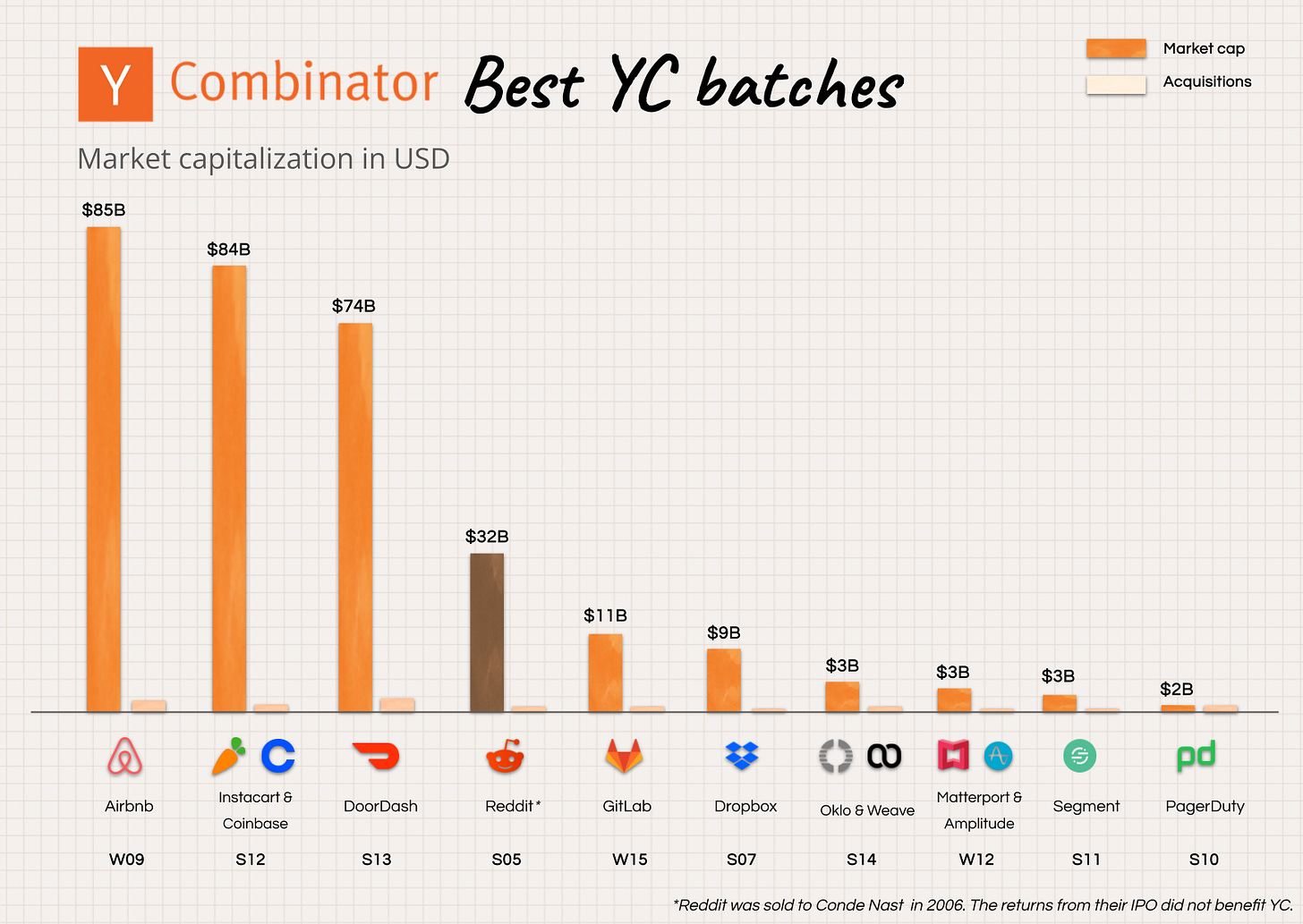

W09, S12, and S13 remain the best YC batches based on IPOs and acquisitions

During Paul Graham’s leadership, YC was fortunate enough to invest in some of the most industry-defining consumer companies. Airbnb, DoorDash, and Instacart were riding the shift to mobile, and Coinbase became the leader in the crypto revolution. Today these are the top companies YC has ever backed based on market cap value.

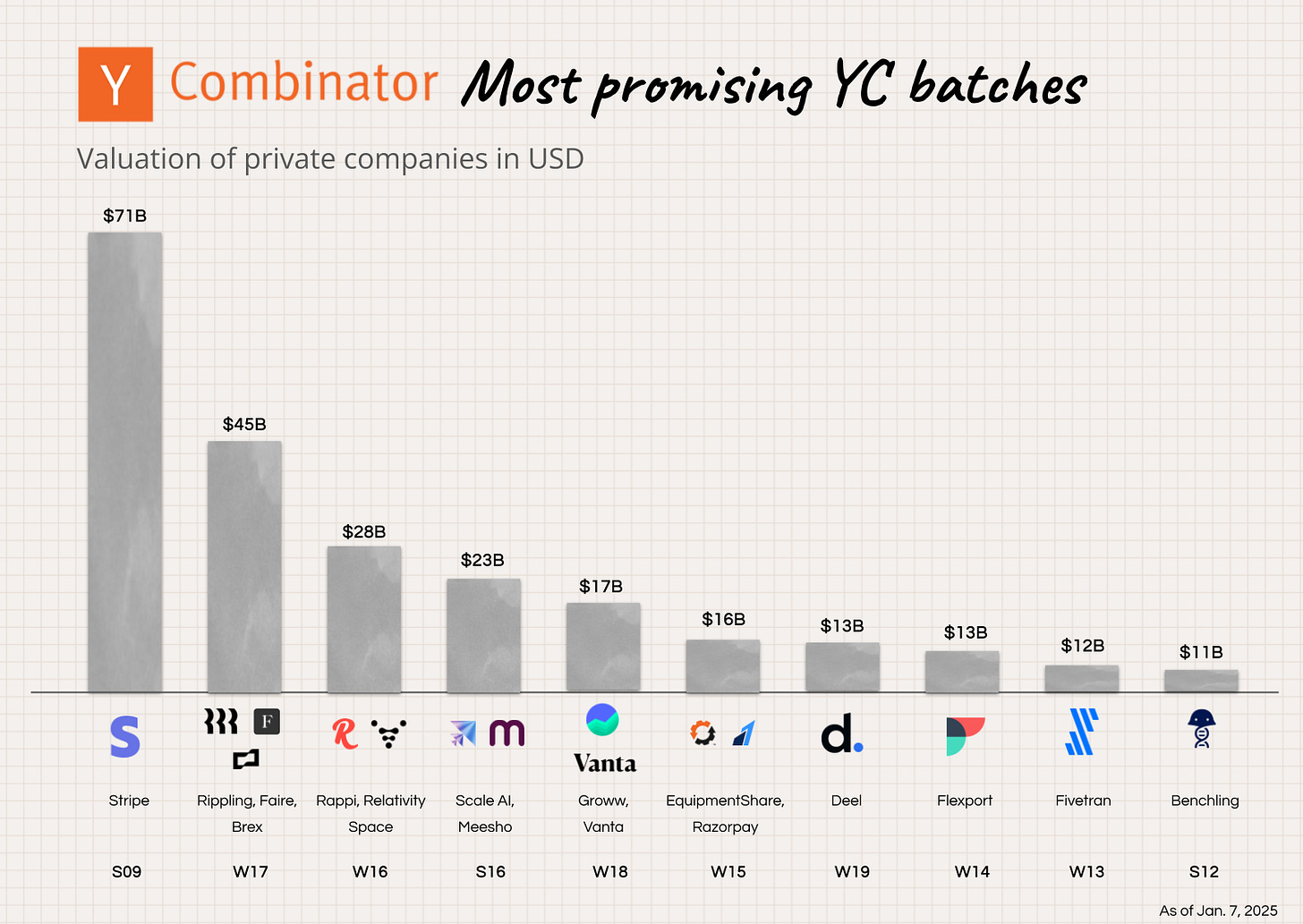

The most promising batches are S09, W17, and W16

When we look ahead, there are some very interesting batches that may soon materialize on the public markets. S09, with Stripe, might overtake Airbnb as the most valuable YC company ever. W17, with Rippling, Faire, and Brex, is also looking exciting. Personally, I believe there is a lot of upside in S16, which is the vintage with Scale AI, one of the hottest AI companies out there now.

What are the most successful conditions for YC startups?

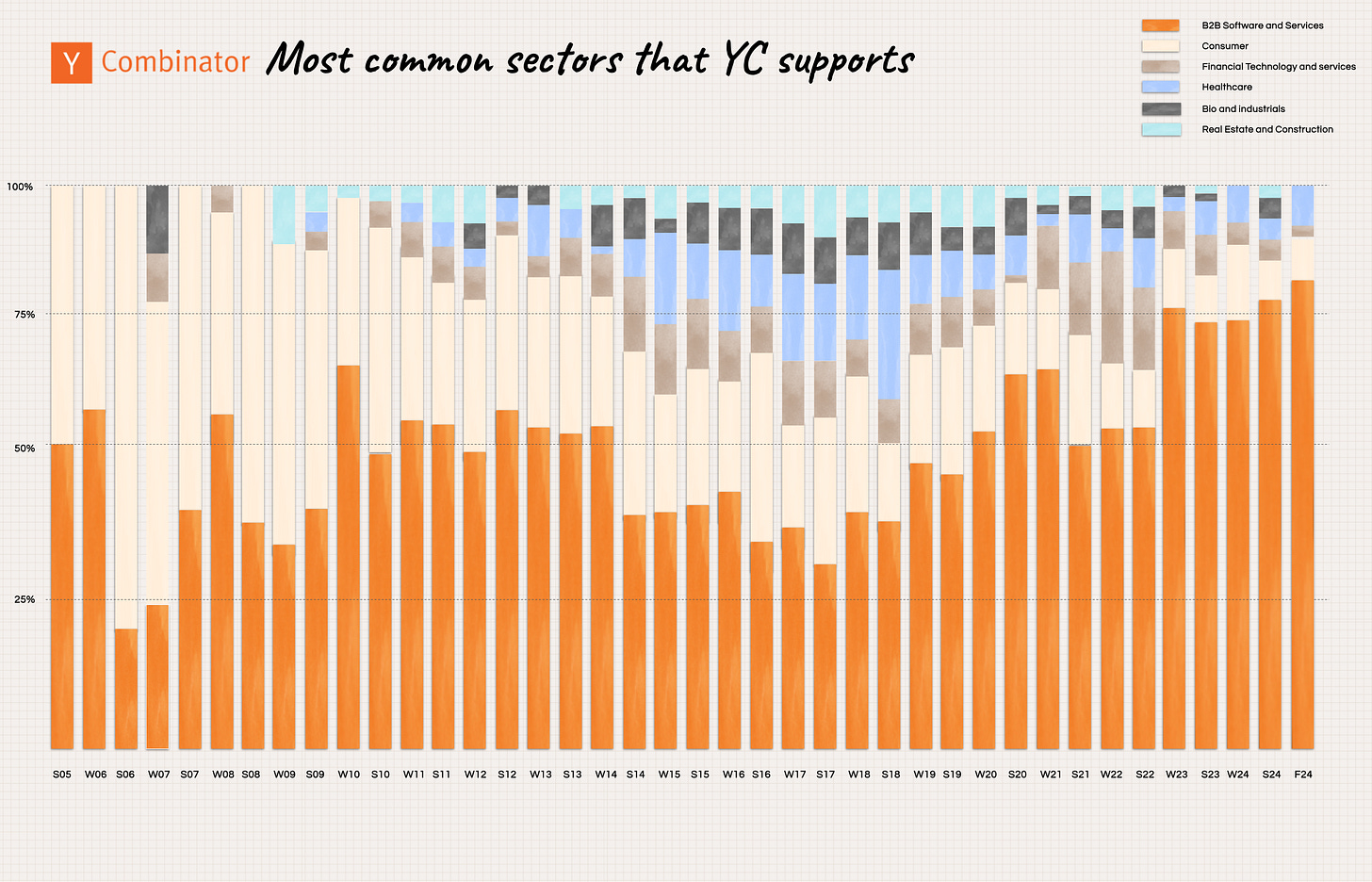

YC has gone from being a Consumer investor to primarily a B2B investor

Although YC are famous for their Consumer investments (e.g. Airbnb, DoorDash, Reddit, Coinbase), the majority of their funding has actually gone into B2B companies. This is particularly true for their most recent batches, where more than 75% of the companies are defined as B2B companies. The shift away from Consumer is likely driven by the fact that most of the large consumer apps have already been invented.

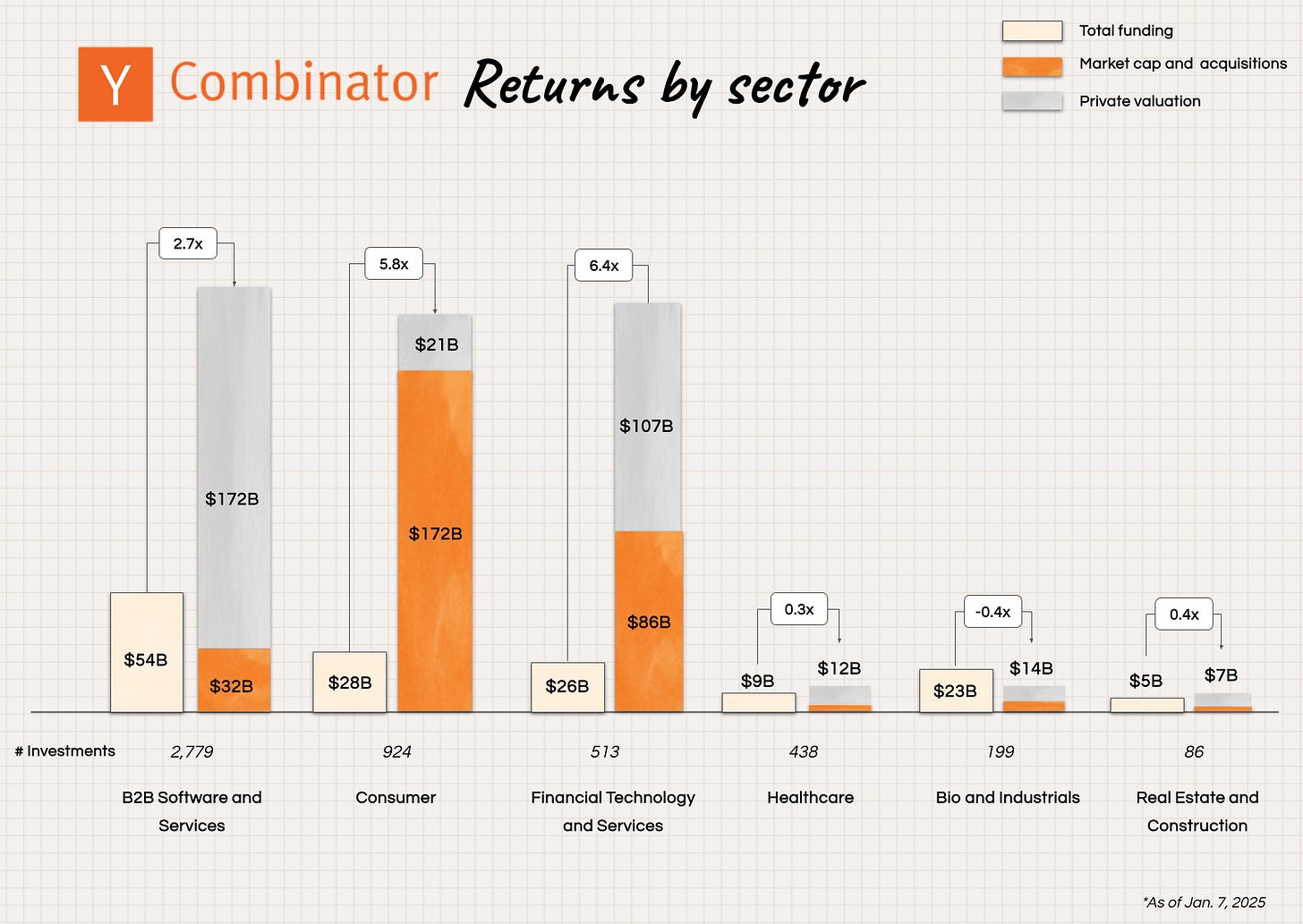

Future returns will be driven by B2B and fintech

The best past investments from a returns point of view have been great consumer startups like Instacart, Airbnb, DoorDash, Coinbase, and others. However, looking forward, the large exits for YC will come from B2B and fintech companies with combined valuations north of $270 billion. So far, YC has not had financial success with their investments in Healthcare, Bio and Industrials, or Real Estate and Construction.

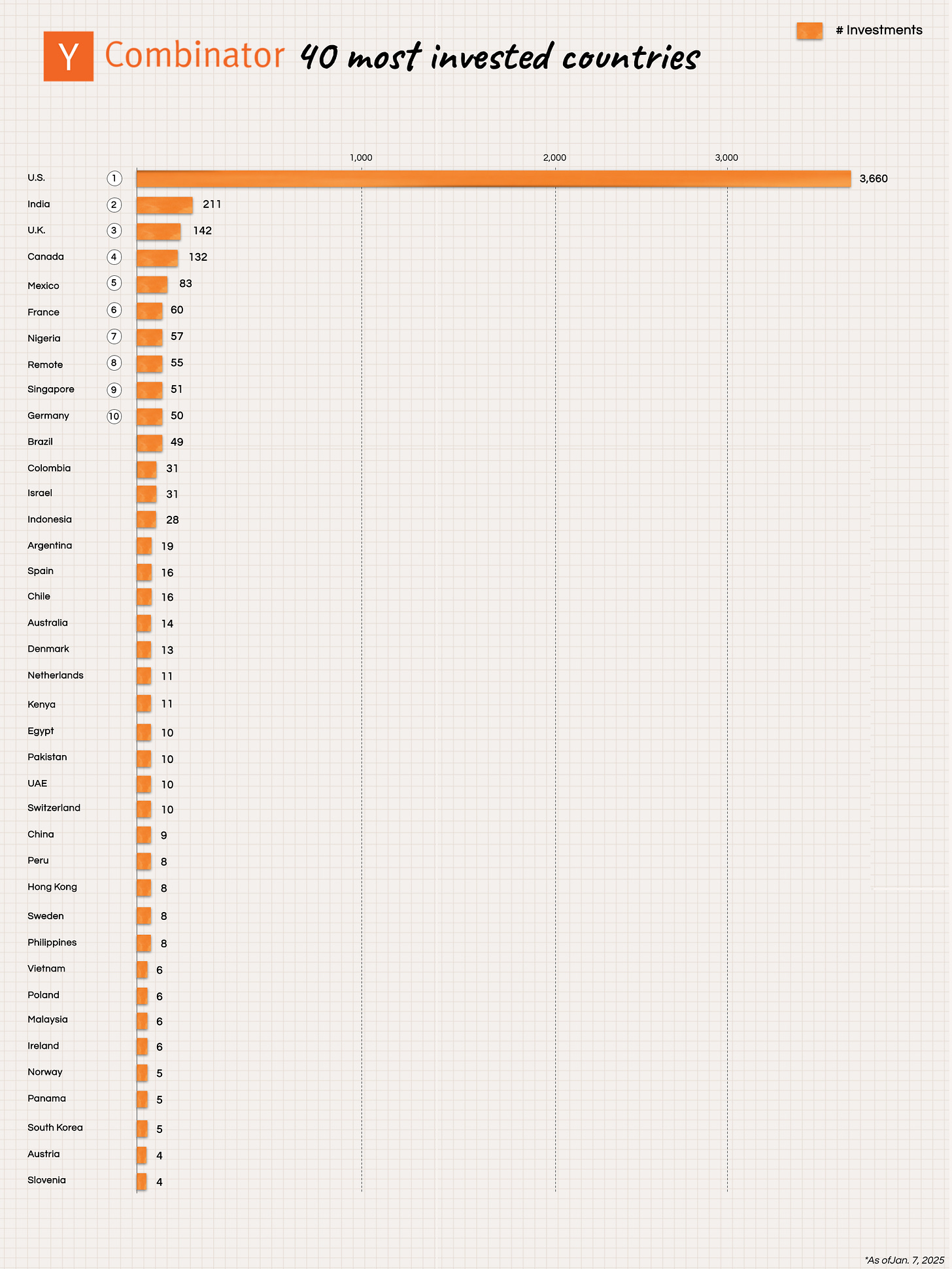

By far the majority of investments go to U.S.-based companies

It is probably no shock that the largest number of YC-backed companies are based in the U.S. More than 70% of companies are from the U.S., followed by countries such as India, the U.K., Canada, Mexico, and France.

So far, 99% of the returns are coming from the U.S.

The only meaningful returns have so far come from U.S. investments. There are some promising bets from overseas, such as Razorpay at $7.5 billion (India), Rappi at $5 billion (Colombia), Zepto at $5 billion (India), Meesho at $4 billion (India), and Flutterwave at $3 billion (Nigeria). Slightly surprising is that European-based companies are still lagging behind when it comes to valuations and market cap value. The most valuable European YC company is GoCardless at $2.1 billion.

Solo founders are at a disadvantage

There’s a lot of discussion of whether being a solo founder makes it statistically harder to succeed (or get into YC). When Sam Altman was the president of YC, he wrote, “We really prefer at least two founders, but it’s not a deal-breaker.” And the data speaks quite clearly. Over the past few batches, the proportion of solo founders in the batch has gotten smaller and smaller, to around 10% in the latest batches.