How GiveDirectly increased donations by over $3 million/year through experimentation

Wins, misses, and lessons from GiveDirectly’s donation-optimizing journey

👋 Welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Lennybot | Podcast | Hire your next product leader | My favorite Maven courses | Swag

Happy Giving Tuesday! Today is the biggest donation day of the year, and, to celebrate, I’m sharing a unique and inspiring guest post by the team at GiveDirectly, a nonprofit that sends cash directly to people in need.

I’m a huge fan of the work they do, so I’m also kicking off a campaign through GiveDirectly to raise $100,000 to bring a rural village in Kenya out of poverty. All donations made to this campaign today, on December 3rd, 2024, will be doubled thanks to an anonymous donor matching pool (while funds last).

Your donations will help all 157 families in a village in Baringo, one of the poorest regions in Kenya. Each family will receive about $850 via digital transfer to spend and invest how they see fit. People living on about $1 a day know what they need, and they spend donations on things like eating more than once per day, sending kids back to school, starting a small business, seeing a doctor, and “simple” stuff like buying their first mattress. For less than half the cost of the average month’s rent in the Bay Area, you can give an entire family a life-changing opportunity.

Here’s the story of Rose and her family:

“With three children, no job, and divorced, I take on any manual work I can find to put food on the table. Some days, I wash clothes for other people, other days I gather firewood for restaurants at the local town center, and sometimes I fish to earn a living. When there’s absolutely nothing, I go to the lake, catch some fish, and prepare it for supper with my kids.

I see the cash transfers from GiveDirectly as a real turning point for me. I plan to open a small retail shop to sell fast-moving goods, giving me a steady income and, hopefully, putting an end to the income uncertainties. I also plan to buy livestock, which I can raise and eventually sell at a profit.” —Rose in Kenya

Here’s the GiveDirectly team on the benefits of a cash-based donation approach—which I love:

Cash works. It’s among the most data-driven ways to help (more than 500 academic studies—basically A/B tests for charity interventions), and GiveDirectly is building this evidence base by running the world’s largest UBI study, among other research.

It’s proven to work in some ways you might expect—e.g. income, psychological well-being, food security, entrepreneurship, education boosts.

And some you might not—e.g. improvement in gender equity, reduction in domestic violence, reduction in alcohol and drug use.

It’s tech-enabled. Donations are sent directly to families in extreme poverty via mobile money technology, making it more scalable than other poverty solutions.

It also lends itself to innovative approaches, e.g. using AI for targeting to deliver emergency cash faster or even before disasters.

It’s respectful and anti-paternalistic. Too often, “experts” have said people in poverty need laptops, water pumps, or chickens—top-down decisions that haven’t worked. Rather than “teaching a man to fish,” consider that often people know how to fish but cannot afford the boat. They want to sell cassava, say, or go back to school.

It’s simple. Sometimes people who don’t have money just need money!

My goal is to raise $100,000 and bring this village in Baringo out of poverty. Help me make this dream a reality.

All donations are tax-deductible in the United States. GiveDirectly accepts all major credit and debit cards, PayPal, checks, wires, stocks, cryptocurrencies, and more.

Now, on to today’s post. . .

Charities aren’t known for being the most tech-forward. Most nonprofit donation flows look like this:

At GiveDirectly, we asked: What would a better online donation experience look like? After only one year of experimenting with this one critical flow, we’ve raised $3 million more in incremental donations per year—meaning that about 3,000 more families in extreme poverty receive a life-changing cash transfer every year going forward.

In your own product—nonprofit or not—you can apply the same strategy. Here are the experiments that worked for us (and some that didn’t) that you can try to optimize your own funnel:

Tiny changes can add up to a big difference

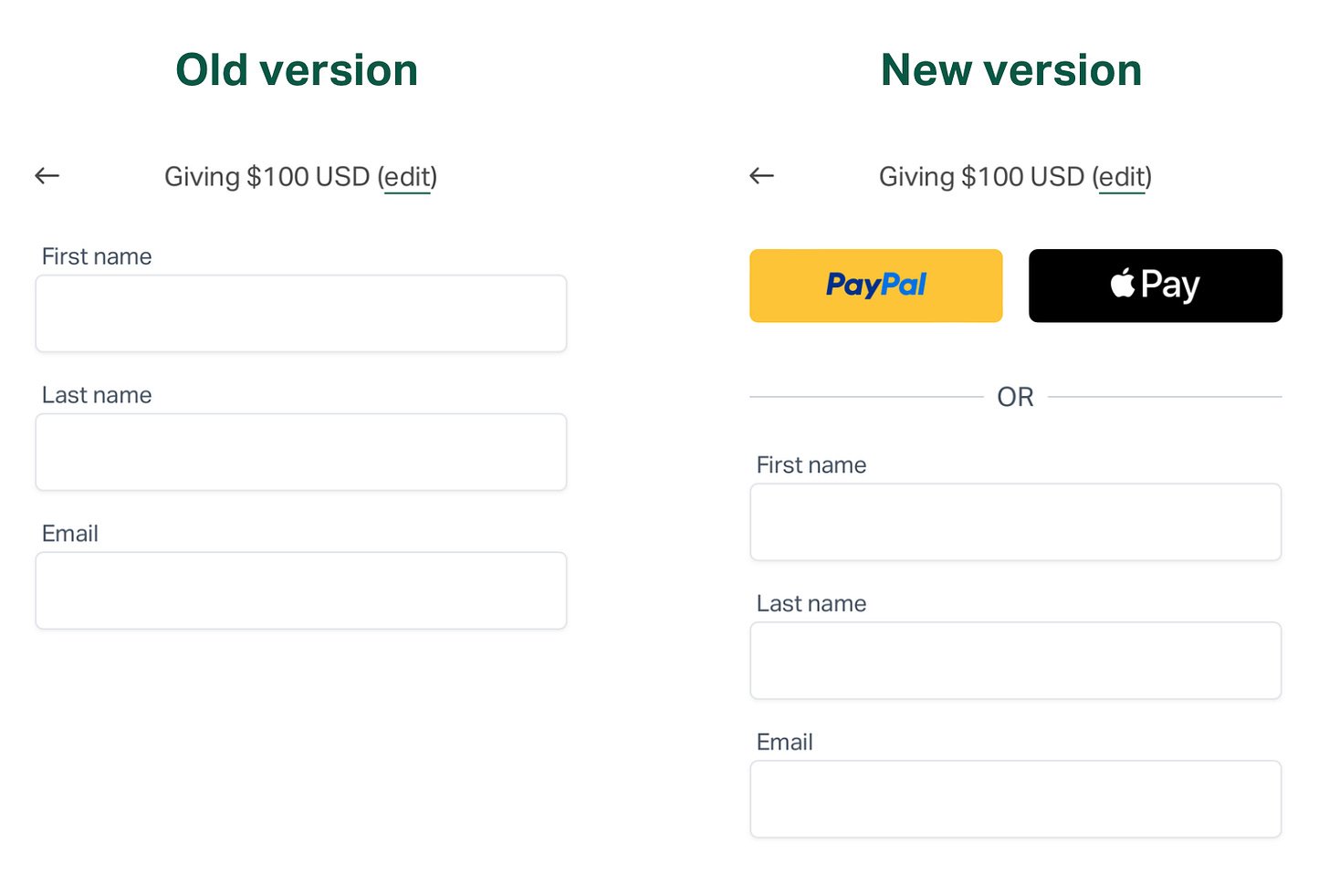

1. 💳 Adding one-click PayPal and mobile wallet checkout options raised an incremental $1.3M per year (a 14% increase in online donations!)

Donors often don’t have their payment information handy, so we wanted to reduce the number of steps to complete a donation by adding an express PayPal option, Apple Pay, and Google Pay at the top of the checkout page.

Not only did this make it easier to pay, but we didn’t have to ask for the donor’s name and email address, since we get their info directly from PayPal or the mobile wallet. We also think these brands help serve as a trust signal to donors; 20% of our online donations are now made through Apple or Google Pay.

We learned that adding more payment options gives donors the flexibility to use their preferred method, too. For example, adding ACH direct debit was helpful for donors giving bigger donations, providing an easier alternative to mailing a check and helping us save on transaction fees (the ACH fee is capped at $5, while credit card fees are about 2%). We estimate this saves $50,000 per year in fees alone.

2. 📧 Tweaking the copy asking donors to opt in to emails doubled the subscription rate, driving an incremental $400,000 a year

Email is our primary channel for telling donors about our work and asking them to give, so it’s crucial to maximize the number of donors who subscribe. Historically, only 25% of donors opted in to emails during checkout. After we changed the checkbox copy to be up front about how many emails they should expect to get and why they should subscribe, the share of donors who subscribed more than doubled to 55%:

While there’s some selection bias in donors who choose to opt in, those who subscribe retain two to three times as long as donors who don’t. We conservatively estimate that the increase in donor email subscription rate drives $400,000 a year.

If a test fails initially, try a second version

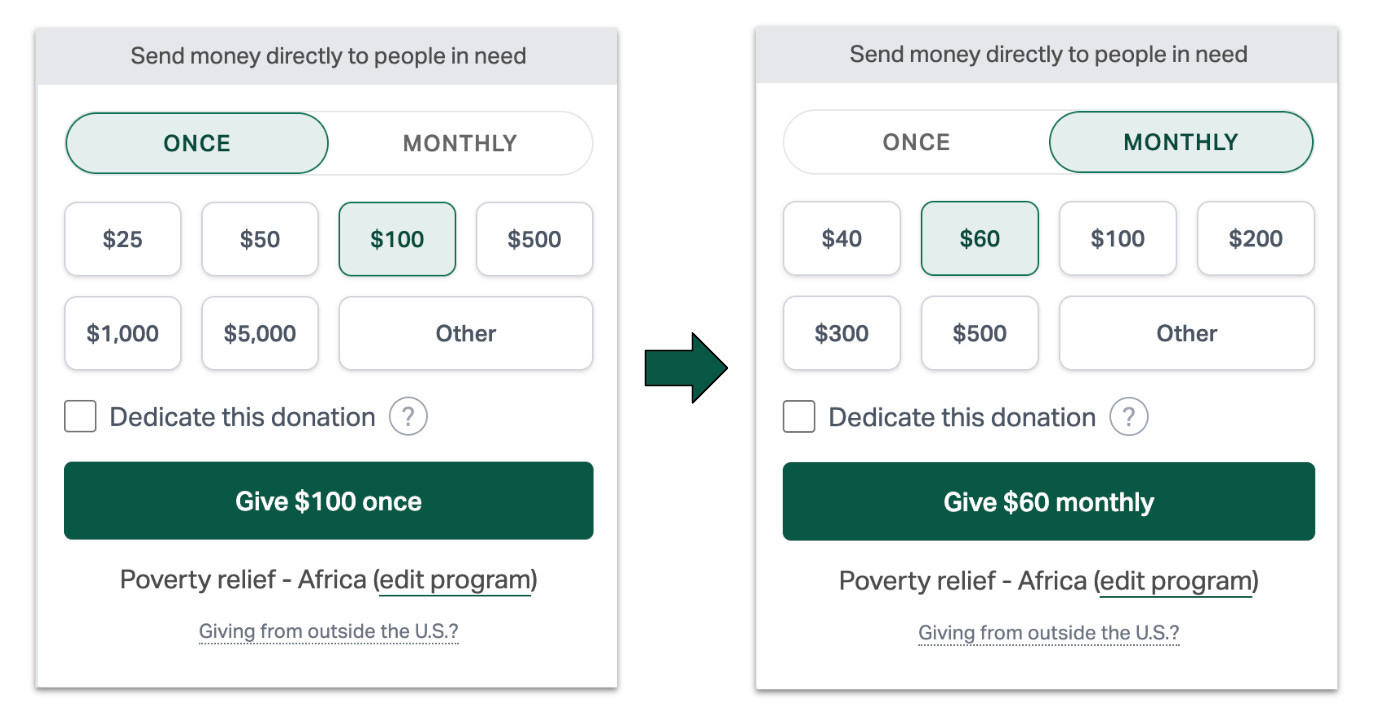

3. 🗓️ Encouraging monthly donations drove an incremental $500,000 a year

We estimate that the average lifetime value of a recurring GiveDirectly donor is 12 times that of a one-time donor, so we wanted to test ways to prompt more people to start a monthly donation.

❌ Didn’t work: We tried showing a modal asking people to switch to a monthly donation of $X/12 after they started a one-time donation of $X:

This made people seven times as likely to start a monthly donation, but one-time donation conversion decreased by 10%—likely due to the added friction of the extra step. The increase in monthly gifts wasn’t enough to compensate for the decrease in one-time gifts.

✅ Worked: We tested simply setting the default donation frequency to be monthly instead of one-time:

One-time donations still decreased slightly, but the lifetime value of the increased monthly donations outweighed the one-time donation decrease in this iteration. Smart defaults FTW!

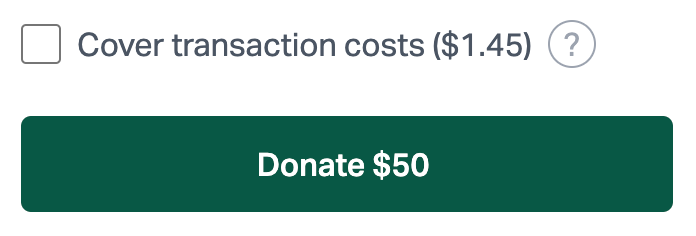

4. 💸 Asking donors to cover transaction fees raised an extra $200,000 a year

We pay around $400,000 in payment transaction fees per year—that could go to life-changing cash transfers for 400 more families in poverty. We wanted to see if donors would be willing to help cover some of these costs.

❌ Didn’t work: We added a checkbox for donors to cover the payment processing fees for their donation, with the checkbox checked by default:

Surprisingly, the donation conversion rate for the test group with this new checkbox was 6% lower than the control group without it. Our hypothesis: People were put off by seeing a different amount on the donate button than they had originally intended to give.

However, 85% of people who completed a donation ended up covering the fees, showing that people were willing to “round up” their donation.

✅ Worked: We changed the checkbox to be unchecked by default:

The share of donors who covered fees decreased from 85% to 60%, showing the power of defaults—but the conversion decrease disappeared, so we shipped it.

When it comes to product nudges and defaults, it’s worth testing a few iterations to see if you can find a win. Staying focused on our North Star metric (total dollars raised) also allowed us to recognize when to accept decreases in other submetrics.

Homepage design and interactivity matter

5. 🎨 A homepage with a more polished design and embedded donation form raised an additional $700,000 a year (our second biggest lift ever)

GiveDirectly’s very small fundraising team only had the resources to maintain a pretty bare-bones website for many years. Even until 2023, it was still simple and—dare we say—boring:

We knew it was time to upgrade our homepage, and used it as an opportunity to run a three-arm test.

Our goal was to find out:

Does a polished homepage with more recipient voices raise more money than a simple homepage?

Does embedding the donation form raise more money than a simple “donate” button?

✅ The result: A website visitor was 35% more likely to donate (that’s huge!) if they saw the new design with the embedded donation form instead of the old one. Conversion increased from 1.98% to 2.67% (strong for the nonprofit industry, which averages about 1%).

Of this uplift, 20% was driven by the embedded donation form, and 15% was driven by the new design. Because of these results, we’ve made other web pages (like this one about extreme poverty) more robust and are seeing them drive more donations.