A guide for finding product-market fit in B2B

Part five of my seven-part series on kickstarting and scaling a B2B business

👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career.

Welcome to part five of our ongoing series on how to kickstart and scale a B2B business:

Part 2: How to validate your idea

Part 3: How to identify your ICP

Part 5: A guide for finding product-market fit ← This post

Part 7: How to scale your growth engine

A huge thank-you to Akshay Kothari (COO of Notion), Ali Ghodsi (CEO of Databricks), Andrew Ofstad (co-founder of Airtable), Barry McCardel (CEO of Hex), Boris Jabes (CEO of Census), Calvin French-Owen (co-founder of Segment), Cameron Adams (co-founder and CPO of Canva), Christina Cacioppo (CEO of Vanta), David Hsu (CEO of Retool), Eilon Reshef (CPO of Gong), Eric Glyman (CEO of Ramp), Guy Podjarny (CEO of Snyk), Jori Lallo (co-founder of Linear), Julianna Lamb and Reed McGinley-Stempel (co-founders of Stytch), Keenan Rice (founding team), Mathilde Collin (CEO of Front), Rick Song (CEO of Persona), Rujul Zaparde and Lu Cheng (co-founders of Zip), Ryan Glasgow (CEO of Sprig), Shahed Khan (co-founder of Loom), Shishir Mehrotra (CEO of Coda), Sho Kuwamoto (VP of Product of Figma), Spenser Skates (co-founder and CEO of Amplitude), Tom Preston-Werner (co-founder of GitHub), and Tomer London (co-founder and CPO of Gusto) for contributing to this series. Art by Natalie Harney.

If you’ve come here looking for a step-by-step guaranteed guide to finding product-market fit, you’re going to be disappointed. No such guide exists. Nor will one ever exist. Finding PMF is too squishy. As Rick Rubin said in his recent book The Creative Act, “If we’re aiming to create works that are exceptional, most rules don’t apply.”

However, there is hope. Though there’s no formula for finding PMF, you can significantly increase your odds, and save yourself a lot of time and heartache, by studying the lessons of those who’ve made it. I interviewed more than 20 of today’s most successful B2B founders, and from their stories, I’ve found:

A simple framework for moving closer to PMF

Reliable signs that you’re approaching PMF

How long it should take you to find PMF

Advice for what to do if you aren’t finding PMF

Let’s get into it.

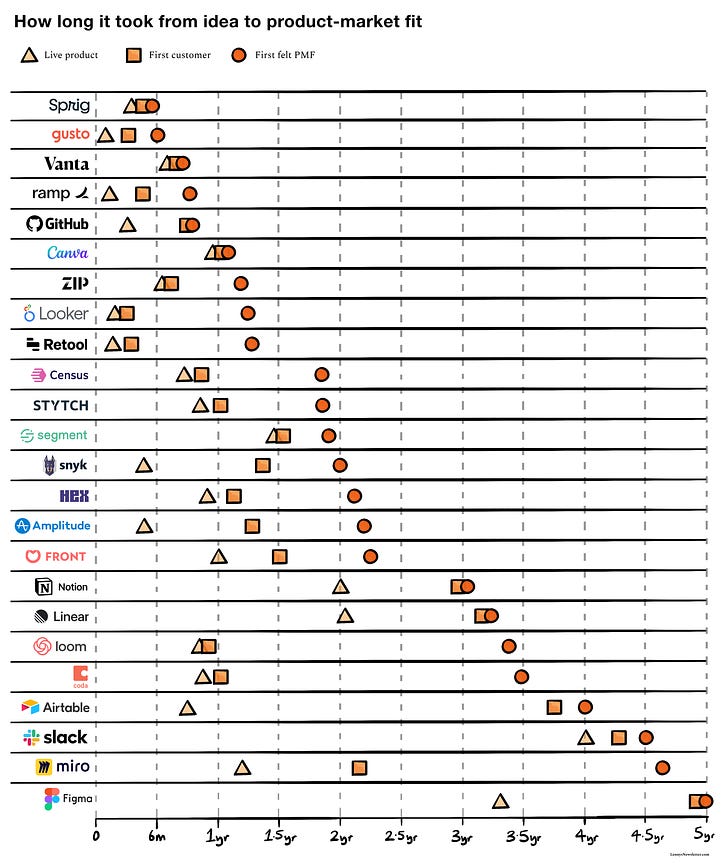

In B2B, it normally takes two years to start feeling product-market fit

Here’s an overview of how long it took 24 of today’s top B2B startups to get to (1) a live product, (2) their first customer, and (3) their first feeling of PMF:

The median time from idea to feeling product-market fit was roughly 2 years. Start to worry if you’ve been working on your idea for over 2 years and not feeling PMF (see below what that feels like), and start to seriously worry if it’s been over 3 years.

From a working product to feeling PMF typically took 9-18 months. Expect to spend a year or so iterating before you finally have something people want.

Most companies got an alpha product out the door in 1-3 months. Unless you think you’re the next Figma, get your V1 out quickly.

A few companies—Figma, Airtable, Slack—took 4+ years to find PMF, but they were the exceptions, and Slack was working on a completely different product (a game) before pivoting to what became Slack.

Additional takeaways and surprises from the insights below

If you build it, they will come—if you have strong product-market fit.

Stop thinking of product-market fit as a yes or no question—but instead as a process of finding fit with more segments of the market.

Surprisingly, no founders I spoke with used retention as their signal of PMF. It might have been implicit, but if you read the quotes, that wasn’t really ever the main story.

The journey to PMF starts by finding just one company to truly love your product.

One of the most interesting takeaways from my interviews is how often founders never fully felt PMF

Shishir Mehrotra (co-founder and CEO of Coda) described this feeling so well:

“My problem with the term is that you always have product-market fit with one group and not with the next. The group that you haven’t achieved product-market fit with is the one you really want to target.

It always surprises people to hear that, at YouTube, we never thought we had a product-market fit. We had 100 million DAUs and almost a billion monthly actives, and yet we did not have our desired audience. We had teenagers but not adults. We were envious of the satisfaction those folks were finding on Netflix, Facebook, or wherever. In my experience, you’re always stretching product-market fit. I don’t think there’s a moment where you’re done with product-market fit.”

You may not feel like you have PMF even when you reach 100 customers:

“I remember with the first 100 or so customers, every customer kind of felt like the last customer we would get, to be honest. We were like, I can’t believe DoorDash is using this product. That’s incredible! We were so proud. Unlike on the B2C side, there was no sort of viral loop that got going that made us think, ‘Okay, we found it.’ Instead, it really was kind of just pushing the boulder at a pretty steep trajectory uphill, over and over.”

—David Hsu, founder and CEO of Retool

Or at $100M/year in revenue:

“The fear of hitting a wall and collapsing was always there. Even when we were at 100 million in revenue, there was always this fear that we were suddenly going to crash into a wall and everything would stop.

There are all these horror stories in Silicon Valley of these companies who got to 150 or 200 million revenue and then didn’t grow. So there was always this fear that it was going to happen to us as well. Your product-market fit is always with respect to a particular market. It might be small companies, or medium-size companies, or enterprises. The small companies don’t want your stuff, or the U.S. market doesn’t want your stuff, or the Asian market, and so on. Eventually, at some point you become a multi-product company, so then the whole game repeats itself again and again and again. You have to revamp and change things significantly, which is its own challenge.”

—Ali Ghodsi, co-founder and CEO of Databricks

In fact, you might never fully feel PMF:

“I never felt at any point of time like, ah, now I have product-market fit. I always felt like there was always something for us to improve on—whether it was growth or product or customer care. I’m always seeing what more we can do to solve problems on behalf of our customers.”

—Tomer London, co-founder and CPO of Gusto

“I’ve spent most of the history of Hex paranoid that we’re not at PMF, or there’s more to do. I think our vision is big enough and that, at any point, even when I have thousands of people telling us this thing is awesome, I still feel like, ‘Yeah, but there’s this bigger thing we want to do.’ I don’t feel like we have product-market fit for the ultimate vision we have yet. And so that’ll take time, obviously.”

—Barry McCardel, co-founder and CEO of Hex

“I don’t even know if today we have true product-market fit. If you’re going down the venture path, what I tell other founders is that anytime you raise, your product-market fit is gone, because whatever you raised, the next raise effectively demolished it. You now have to hit the next bar of product-market fit. What we have today at the series A and series B, I consider it strong product-market fit. But that’s because we were able to grow into the valuation and what the stature of the company should have been at those respective stages.”

—Rick Song, founder and CEO of Persona

PMF is never a binary yes-or-no moment. It’s instead a gradual process of finding fit with larger and larger segments, as Jori Lallo, co-founder of Linear, describes:

“PMF has been so gradual; I might even say . . . linear. There’s not just one hump that we got over and thought, ‘Okay, now it’s clicking.’ It’s more like we’re chipping away at these obstacles and getting more and more people interested. It’s more like, ‘Oh, this is really working for certain segments.’”

A guide for finding product-market fit

Though you may never feel everlasting product-market fit, you need to start somewhere. I asked every founder when they first felt product-market fit, and their answers fell along a spectrum that provides a useful guide to finding ever-increasing PMF:

Step 1: Get one company to love your product

Step 2: Get one company to pay (a meaningful amount of money) for your product

Step 3: Get more than one company to love and pay for your product

Step 4: Start noticing a shift from push to pull, and organic growth

Step 5: Keep growing consistently

Below, I’ll explore each step in-depth, and share stories from founders of the moment they finally felt PMF.

Step 1: Get one company to love your product

Start your PMF journey by becoming obsessed with getting one company to love, use, and continue to use your product. Do whatever it takes to make them successful.

In the case of Figma, co-founder Dylan Field became obsessed with the success of their first real user, Coda (originally called Krypton):

“There was a weekend when we had a bug and the product wasn’t working very well because it hadn’t been released yet; it was an alpha. And Dylan was freaking out. He’s like, ‘There’s a bug.’ And I’m like, ‘Yeah, we’ll fix it, but we’ve got other stuff going on.’ He’s like, ‘We have to call a red alert.’ I’m like, ‘Dude, what are you talking about? We haven’t shipped this thing yet. There’s no such thing as a red alert because it’s not shipped.’ And he’s like, ‘You don’t understand. There are customers depending on us. There’s this company called Krypton.’ So I was like, ‘Okay, they haven’t paid us any money, nobody even knows we exist, but I guess we’ll deal with it.’

I actually came to appreciate Dylan’s mindset, because a lot of founders don’t give a shit about their customers. They want to understand the customers, but just enough to figure out what features they would be willing to pay for. But at the end of the day, Dylan was thinking about it in terms of trust. He was like, ‘Look, I convinced this guy to use our product. They’re actually trying to use it for work, and if we fuck it up for them, I don’t want that on my conscience. I want to do whatever I can to make sure that we’re holding up our end of the bargain. Because they believed in me.’

They’re still customers; they were our first customer.”

—Sho Kuwamoto, VP of Product

Coda itself went through this same journey with their first customer, Springful:

“My former colleague Noam Lovinsky [now CPO at Grammarly] was starting a company called Springful. I said to him, ‘Hey, would you use Krypton [our name at the time]?’ They started using it, and for a while, it went well. They were getting a lot of use out of it. We had a chart of what the DAUs looked like, and because they had six employees, the chart basically sat at 6 every day, except for on the weekends.

Then one day, it dropped to zero on a weekday, and the following day, it stayed at zero. And so I texted Noam and said, ‘Hey, what happened? Are you at an offsite?’ I was trying to find some other excuse. He said, ‘Oh man, I’ve been putting off calling you, but I have good news and bad news. The bad news is we had a team meeting and I asked the team how things were going, and they said that if we made them keep using Krypton, they were all going to quit.’ And I was like, ‘Well, that’s pretty terrible news.’ He said, ‘The good news is they all completely believe in the vision. They’ve made a list [in Krypton] saying, ‘If you do these things, we’ll come right back.’ The list was like 25 things, all completely reasonable.

This led to a big internal debate. The team was basically divided in half. Half the folks had a mindset like, ‘What a gift. We have a customer and they have given us a clear list of requirements.’ The other half said, ‘He’s reacting to the wrong product—it’s not actually the shape of the thing we want. And if we do that, we’re going to dig a hole deeper and deeper into this part of the product.’

We decided not to finish his list. Instead, we built the doc that we originally envisioned. I thought it would take three or four months, but it took over a year to get back to his list.”

—Shishir Mehrotra, co-founder and CEO

David Hsu at Retool built a tool to catch anyone running into issues with their early product so that they could fix the issues immediately:

“At the beginning of any startup, no one knows about your product, nor does anyone use it. We came to a point where we’re like, given that no one’s using the product, every time somebody’s using the product, we should go see what they’re doing. So we built this custom analytics server along with FullStory, and anytime anyone was in the app and using the app, we got notified immediately on Slack.

Invariably, they’d run into a bunch of issues. And anytime they ran into any issue, we’d immediately reach out. We’d just call them. With sales, oftentimes when you call a customer, they don’t reply or they don’t want to talk to you. But in this case, they were literally using the product and they’re running into issues, and so they were super-likely to pick up.

With DoorDash, for example, the product went through multiple iterations over three weeks, where they’d uncover an issue and we’d respond, ‘No problem, we’re on it.’ We’d ship the feature, they’d come back the next day, it would work. They wanted an on-prem option, which is at that point a pretty big feature, as you can probably imagine, putting a cloud product on-prem. We’re like, ‘No problem.’ And we shipped it in just 36 hours. So we were iterating very rapidly, even if the core idea was the same.”

The founders of Gong did exactly the same thing:

“During the beta process, we had a bunch of systems that recorded the users’ screens using Gong. And we were watching these like maniacs, every day. I would probably spend two hours watching people interact with the system, reverse engineering them based on their role or what they were trying to do, and then go on thinking, ‘So this is what this person is doing?’ And if needed, I would give them a call. This approach is an underutilized product management tool, because in some areas it gives you more information than a quantitative survey or a discussion, because this is what the person actually does versus what they tell you and what they think they’re doing.”

—Eilon Reshef, co-founder and CPO

The founders of Gusto literally sat next to their early customers watching them send payroll day after day:

“For the first 30 customers, I was with them in their offices seeing them do payroll, or I was on the phone with them, watching them and then seeing them send payroll, and their reactions and seeing feedback. What’s working, what’s not working, what’s intuitive, what’s not intuitive. Every time they added an employee, I was there on the phone with them or in their office.”

—Tomer London, co-founder and CPO

The founders of Looker are famous for going even further and “forward deploying” their engineers to sit in the customer’s offices and work alongside their team to make sure they’re set up for success:

“The best way to show a prospect or customer the real value of Looker was to show them on their own data. Its power came from being designed as both a language and a development platform, but that also came with a lot of overhead to learn how to be powerful with it. It wasn’t rocket science; it just took time.

Therefore, we created a team of data analysts to serve as our technical customer-facing teams (sales engineers, customer support, and implementation analysts) to quickly deploy and develop instances of Looker for our customer. Early on, this enabled us to see and know everything that our customers and prospects wanted to achieve with analytics. Having that insight, we were able to both develop features and ways to use Looker, almost daily, to ensure we would be the best choice for a powerful analytics platform. This also helped us ensure that our customers would find value from Looker on day 1 after purchasing.”

—Keenan Rice, founding team

“You won’t be great for anyone. Just get the thing to be really damn useful for one customer.” —Barry McCardel, co-founder and CEO of Hex

One of the biggest recurring lessons from my conversations is to talk to customers more. I know you hear this a lot, but you are probably still not talking to customers enough. Here’s Spenser Skates’s (co-founder and CEO of Amplitude) hard-won lesson:

“We spent about a year building, when in retrospect, we should have spent half that time talking to customers. And if we had, we would’ve wasted a lot less time on customers who were never going to buy.

The biggest thing I will tell founders is, you have to spend half your time talking to your customers. If you’re a B2B company, that means becoming a salesperson. Figure out how to spend the collective time of your founding team: 50% needs to be talking to customers. If you’re a consumer company, that just means talking to them and meeting them. Airbnb was very famous for doing this. And spend the other 50% of your time building.

I’m an engineer. My two co-founders, Curtis [Liu] and Jeffrey [Wang], are engineers. And so our instinct is to always build the product because we know how to solve those problems. But we wasted a lot of time solving problems that didn’t really exist or didn’t have money or traction behind them. And so that was a huge lesson for us.”

At this stage, you may not even have true “product”-market fit, if your product is early. Instead, you can look for “message”-market fit, as in the case of Ramp:

“When we launched, in mid-2020, I think we had ‘message-market fit.’ We were able to differentiate and have people be interested in our unique messaging, but we didn’t have the product there yet.

I think it’s hard to have true product-market fit when you’re public. When you’re operating just on friends and founders you meet and VC introductions. You need to have people out in the world who you don’t know you but are using you, and the product is what’s doing the selling.

And in terms of the product itself, where suddenly it was spreading, that came later, probably fall of 2020, when it was finally delivering on the messaging we had.

In terms of feeling market-message fit, there’s a few ways you can test it. One, based on launch press coverage, e.g. who wants to talk about it. You send an email using cold outbound and look at response rates. SDRs can do that all the time, and we were testing that all the time, even in an elevator pitch. Would people get it or would they be turned off? You can be very technical about it. You measure it or you can just sort of go by feel.”

—Eric Glyman, co-founder and CEO

Or “product-user fit,” as in the case of Snyk:

“I separate the ‘product-user fit’ from ‘product-buyer fit.’ We got the former pretty quickly, I’d say within a year after we launched our Git integration. The latter— getting people to pay for it and aligning with their commercial needs—took a full extra year to happen.”

—Guy Podjarny, co-founder and CEO

Remember, trust is your secret weapon early on.

Step 2: Get one company to pay (a meaningful amount of money) for your product

The next PMF milestone is to get one company to pay a meaningful amount of money for your product. This should be five to six figures per year. I’ll share pricing advice below.

For Vanta, getting the first five-figure verbal agreement, and then a $500k deal, convinced Christina Cacioppo that she had found PMF:

“During the pricing research, when folks overwhelmingly said they’d pay five figures for the Wizard of Oz prototype of a real-time security report. They thought it was generated by code, but I definitely wrote them by hand.

Then, when I was able to sell the first $500k of Vanta by myself, when I didn’t really know how to sell. I joke that prior to Vanta, the last thing I sold was Girl Scout cookies. I knew it wasn’t my sales skill that was getting these deals closed; it was a testament to the problem we were solving and the product we were building.”

For Stytch, it was getting their first six-figure deal:

“For me, it was probably our first six-figure deal when it was like, ‘Oh crap, a company will actually pay us for this.’ I just remember being consistently surprised that they didn’t say no to the prices that we were putting in front of them.”

—Julianna Lamb and Reed McGinley-Stempel, co-founders

If you have early users telling you that you need to take their money, like with Figma and GitHub, you’re in a good spot:

“I think I didn’t admit it to ourselves until we had a customer, Microsoft, that told us, ‘Hey, you have to start charging for this thing.’ I thought we might have product-market fit. In reality we’d had it for like a year, and I wish that I had recognized that sooner, because I think I would have acted differently.”

—Dylan Field, co-founder and CEO of Figma, via fireside chat with Elad Gil

“When we launched our private beta, we were offering it for free. To our surprise, users started writing to us asking, ‘Can we pay for this?’ They liked it so much, they wanted to pay for it. That was the first sign this was going to work.”

—Tom Preston-Werner, first CEO and co-founder of GitHub

When thinking about pricing, the best advice is to charge more than you think you should.

“I was talking to this company called Super Lucky Casino. I went through the demo and the whole pitch, and we got to the end of it, and they asked me a question I’d never been asked. They’re like, ‘This is great, how much does it cost?’ And I’m like, holy shit, someone wants to pay money for the software I built. I am blown away. And the first thought that popped into my head was like, okay, what’s SaaS supposed to cost? I’m thinking $50 a month.

But then I remember Patrick McKenzie’s advice, which is, ‘Charge more.’ So I’m like, all right, what’s the biggest number I can think of? Well, let me double that number. So maybe $100 a month? Then I thought, wait, no, no, no, no, no. Let me try adding another zero to it. I said ‘$1,000 a month.’ And the guy who we were pitching, the CTO of Super Lucky Casino, was like, ‘Holy smokes, wow, that’s so cheap, amazing.’ And I’m like, oh my god, all my dreams have been fulfilled. Someone wants to buy the software that I wrote for $1,000 a month. This is incredible.”

—Spenser Skates, co-founder and CEO of Amplitude

And it goes without saying, if these early customers leave, they don’t count. Retention is key, especially early on.

Step 3: Get more than one company to love and pay for your product

Next, you need to get multiple companies paying for your product. For most founders, hitting 3 to 10 paid customers was the moment they felt like they had real PMF.

For Amplitude, Spenser Skates felt PMF once they signed their first half-dozen customers (at increasingly higher prices):

“After our first customer, Super Lucky Casino, signed, came Keepsafe, which we sold for $2,000 a month. Then it was The Hunt for $3,000 a month. And then we sold to HERE Maps, which is a division of Nokia, for $4,000 a month. And then we did a few more deals. Rdio and QuizUp were the two big deals; those were $10,000 a month. We were really cranking. We got from zero to a million in ARR in less than nine months. And so that was really where we started taking off.”

Gong felt like they had product-market fit when 11 out of 12 of their design partners chose to buy the product:

“We had 12 design partners. We gave them the software in January. In May, we made a decision to tell them the betas were over and that we’d start charging for it. Out of 12, 11 ended up buying. So that’s a pretty big signal.

By the way, the reason why we decided to charge money is that during beta, the product wasn’t always working very well. It wasn’t robust in any way or form, and people were complaining left and right when it wasn’t working. So we were like, well, if they are complaining that it doesn’t work, that means they care. If my iPhone doesn’t work, I freak out. But if home speakers don’t work, I don’t give a shit, just like whatever. So that gave us the confidence that at least they use it.

Then we went to charge money for it. With 11 out of the 12 buying, it should have been obvious. But it wasn’t obvious to us. It was like, how come the 12th didn’t buy it?

We later learned that the 12th one’s CRO left while we were doing the beta, and they bought Gong a year later and are still a customer.

One of 11: the salespeople at one point decided they didn’t need it, and turned it off. A day later, we got a call from the CEO saying, who the fuck told you to turn it off? That’s the type of feedback you want to hear to feel like you have product-market fit.”

—Eilon Reshef, co-founder and CPO

For both Zip and Persona, they finally felt they found PMF after closing their 10th customer:

“I don’t think we felt PMF until we had our first 10 customers live and very successful. This took just over a year from the time we committed to the idea. I distinctly remember a deal where our champion cried because her manager hadn’t approved budget for Zip. She actually quit her job because of it (and is now a customer). That was a telling moment.”

—Rujul Zaparde and Lu Cheng, co-founders

“In the earliest early phases, the only really meaningful measure of product-market fit is whether you can close more than 10 customers, and you think you can close more.”

—Rick Song, founder and CEO

With each new customer, you’ll start to feel more and more confident that you’ve got something special, and you should start to feel a pull.