Lessons from 140+ angel investments

Biggest surprises, how to get started, what to look for when evaluating companies, plus a ton of advice from many smart investors

👋 Hey, I’m Lenny and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out about work. Send me your questions and in return I’ll humbly offer actionable real-talk advice.

Q: I want to get into angel investing. How does one get started, and what’s surprised you most about it so far?

Over the past five years, I’ve angel invested in over 140 companies. Twelve have grown into unicorns, 10 more are on track to get there this year, and I suspect many more will get there eventually.

I’ve invested my own cash, scout checks, with the Airbnb alumni syndicate, and the Airbnb alumni fund. AngelList recently shared that I was in the top 20 investors on their platform. All of that is not to say I’ve got it all figured out but rather that I’ve been very active, things seem to be going in the right direction, and, most importantly, I have a bunch of first-party data to learn from.

To answer your question, I’ve spent the past week reviewing all of my past investments, and below I’ve laid out my seven biggest surprises about angel investing so far. I’ve also included advice about getting started, a bit about how I evaluate startups, and, as a bonus, I’ve roped in a ton of my favorite angel investors to share their insights throughout.

Disclaimers:

I only do this part-time, and I only vaguely know what I’m doing. Buyer beware.

These learnings may turn out to be wrong when all is said and done. I’m still very early in my investing career.

I’ve been investing through a bull market. Many people look really smart right now.

I’ve missed many great deals and made many bad investments.

This is not investment advice. I’m just sharing my experience.

Thank you to these amazing investors for contributing their insights to this post: Aaron Schwartz, Alexis Zhu, Andrew Chen, Ann Miura-Ko, Austin Rief, Brian Nichols, Brett Berson, Charley Ma, Christopher Fong, Cristina Cordova, Dan Becker, Daniel Rumennik, David Breger, Harry Stebbings, Jack Altman, Jamie Quint, Jeff Chang, Jeff Kozloff, Jonah Greenberger, Jules Walter, Julia Lipton, Julian Shapiro, Leo Polovets, Louis Beryl, Packy McCormick, Sharrifah Lorenz, Sriram Krishnan, Todd Goldberg, and Varsha Rao 🙏

Let’s get into it.

My biggest surprises about angel investing so far

If you think about it, angel investing is an amazing deal. You give a bit of cash to someone who will work the hardest they’ve ever worked in their life, for years, and if they can make it work, you make a lot of money. Seems almost unfair. But it’s not all rainbows and butterflies. Most startups fail, most angel investors lose money, and it’s a very expensive hobby. Looking at my 140+ investments, here are my biggest surprises so far.

1. I’m usually wrong about which investments will do best

When I invest in a startup, I make sure to record how confident I am in that investment—OK, Good, or Great. Looking back, only a third of my best investments—the companies that are on track to drive the biggest returns—I rated as Great at the time of investing. Meaning, if I invested only in companies I had Great confidence in, I’d have missed out on two-thirds of my biggest successes.

I obviously thought they were a good enough bet to invest in, but I didn’t have 100% conviction in most of the companies I’ve invested in. And it turns out that’s the right move as an angel investor.

“VCs like to pretend that they’re really smart, but ultimately it’s just math. A single 100x or 1,000x deal will return your fund. But it’s nearly impossible to know which deal that will be. The important thing is to invest in enough deals that could 100x+.”

—Julia Lipton, investor

“Conventional investing wisdom tells us that VCs should pass on most deals they see. But our research indicates otherwise: At the seed stage, investors would increase their expected return by broadly indexing into every credible deal.”

—Abe Othman, Head of Data Science, AngelList Venture

Angel investing is much more about not missing the big winners than it is about avoiding losers. And as AngelList found, early-stage investors do best if they invest in every credible deal vs. trying (and usually failing) to pick the few winners. This is also why the general advice is to invest the same check size into every deal—two of my largest markups are also my smallest checks :(

Takeaway: If you see something special about the startup, and there’s a path to a 100x exit, consider investing even if you don’t have full conviction.

2. Most deal flow comes from other investors—not founders, friends, or colleagues

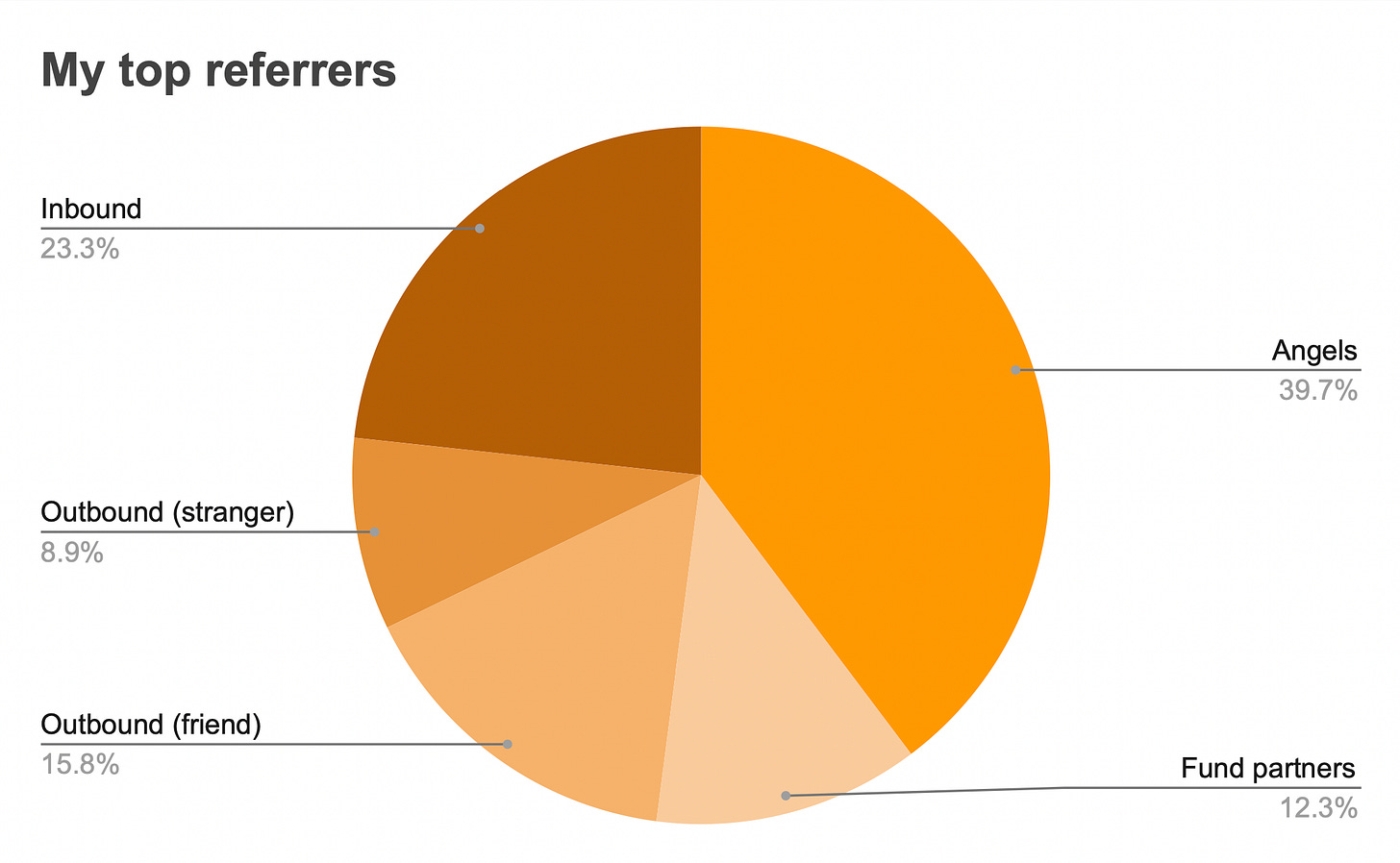

Seven of my first 10 deals were in my friends’ companies. The other three came from other investors sharing a deal with me. As I’ve gotten more active, that ratio has reversed. Now the majority of investments I make come from other investors (mostly angels and solo capitalists).

Takeaway: Increase your deal flow by building relationships with other active investors. The two best ways to build relationships are to:

Build a skill that is useful to startup founders, so that other investors benefit by introducing you to them (e.g. “We can connect you to Lenny, who can help you with growth strategy”).

Share great deals with them, and help them get into great deals.

“You can’t be a great investor if you don’t see any deals. Being a friendly collaborator with other investors is one of the best ways to see more investment opportunities. You essentially multiply the surface area of what you see. And if you share the companies you are most excited about with others, they will do the same, and you can build a good natural filter for deals.””

—Daniel Rumennik, GP at AirAngels

“The best way to get deal access isn’t to be great with founders—it’s to have other investors think you’re great with founders. Build a high NPS with investors, since they have meaningfully more reach than an operator. But of course, fight hard to be great with founders too or else this will all crash down.”

—Aaron Schwartz, investor, 3x founder

Special shoutout to Sriram, Dan, Jamie, Todd, Siqi, and Julian for sharing the most deals I’ve invested in 🤜🤛

3. Great deals are currency among investors

To build on the above learning, the best way to build relationships with other investors, and thus deal flow, is to share great deals with them. The more great deals you share, the more deals they’ll share with you—simple as that. This isn’t always the case due to status differentials (e.g. I share many deals with Sequoia and a16z and barely ever do they share deals with me, lol), but in general this holds true, especially with angels and solo capitalists (where most of your deals will likely come from).

“It’s advantageous (and fun) to be collaborative as an angel investor. Sharing deals with other investors keeps you top of mind for when they’re investing in something. I personally try to only send deals when I’m investing (or very close to it) so my ‘signal’ is strong. In general, I want other investors to be excited when one of my deals is in their inbox. Over the long run, I think being known as a collaborative angel with good taste is most ideal.”

—Todd Goldberg, entrepreneur and investor

“By default, investors mostly share the deals they’re asked to share by founders. Or they share the deals that need help being filled. That has adverse selection (but there are always exceptions, of course, like when founders want ‘strategic angels’!). In contrast, when you get truly close with other investors, some will start proactively pitching you to founders to get you into even the hardest-to-get-into deals. This is why the depth of relationships matters so much more than the breadth in venture.”

—Julian Shapiro, writer and investor

Takeaway: Seek out three to five awesome angel-investor friends and share everything you see with them. Two tips:

Once you decide to invest in a startup, ask the founder if he or she is looking for more great angels. If yes, suggest your co-investors.

Send a weekly email to your angel friends sharing the deals you’re looking at. Share just the URLs and a short blurb, unless you have permission to share the deck. Once you decide to invest, tell them asap in case they also want to try to join the round.

Note: If a founder asks you to keep their round confidential, you need to respect that. But in most cases, if you ask, founders are happy to meet more awesome angels.

4. Angel investing is more about access than picking

There are three parts to angel investing: capital, access, and picking. Based on my experience, access is by far the most important part. If you have access, you can raise capital, and generally the most popular deals (i.e. the ones already discovered) also end up doing well. So picking becomes secondary.

“As an angel investor, it’s more important to be swimming in a pool of good potential investments than to be an exceptionally good picker. Obviously if you’re able to be both, it’s better :) but if you had to choose between being in a position to see great deals and then picking randomly, or coming across average deals and picking expertly, choose the former.”

—Jack Altman, investor and CEO of Lattice

“Judgment is important but overrated.”

—Naval, investor and co-founder of AngelList

Looking at my own data, over two-thirds of my biggest winners were “hot” deals at the time, and similarly, over two-thirds of the hot deals I’ve invested in have gone on to do very well. Not all investments in hot deals will do well, but broadly, getting access to hot deals is key. For that reason, much of angel investing these days is marketing yourself as an investor and getting founders to take your money.

“There are so many incredible founders building great companies today that one of the hardest things to do is to stand above the noise. Even exceptional products need help telling their story and reaching customers and potential hires. Being able to bring that to the table is a leveraged way to help: instead of recommending one hire, you can tell their story to an audience of hundreds of potential hires.”

—Packy McCormick, writer and investor

“With the perfect levels of information that exist today on different firms and investors, the question LPs must ask of investors they evaluate is: Is this investor an aspirational source of capital that the very best founders consistently choose?”

—Harry Stebbings, podcaster and investor

“I hate when people think investing is all about picking winners. This presupposes that as an angel you can get into any deal you want to. Definitely not true! Ask yourself—what is your right to invest in a deal? Working at a16z taught me that we are not just picking companies and entrepreneurs to work with—the best ones are choosing to accept our money. So what is your reverse pitch to entrepreneurs?”

—Louis Beryl, investor and 3x founder

One way to track your “access” is: whenever you see a big fundraising round or great exit, to ask yourself—did I have a chance to invest in that company?

All that being said, your picking skills are still important to build over time. A third of my best investments weren’t in hot rounds, and not all hot deals do well. Even top VCs often make terrible decisions. It’s wise to place a portion of your bets on under-the-radar deals that you’re excited about. Especially if you have unique insight into the opportunity that other investors may be missing.

Takeaway: Work on building your ability to get into hot deals, and don’t stress out about not being able to pick, especially early on.

5. It’s mostly about becoming someone founders want on their cap table

To build on the above point, the best way to get access, and thus accelerate your angel investing career, is to become a person founders want to have on their cap table. There are four paths to this: